Anyone who's been in this business since 2018 knows what a wild ride it's been. In 2019 we finished the season with the lowest levels of bicycle inventory in decades, making it the first year since the Great Recession without prolonged and painful discounting of in-season models ... not to mention the weakest year for U.S. bicycle imports since 1982. (Note these figures do not include burgeoning sales of e-bikes, which are counted under different import codes.)

When the first wave of COVID hit in March of 2020. Suppliers scrambled to cancel orders from factories in anticipation of fewer riders during "shelter in place" programs. But soon enough, retailers noticed the opposite effect: customers — many of whom hadn't set foot in a bike shop in years — were discovering that cycling could be a fun and healthy alternative to public transportation, or just a great way to get outdoors without involving large groups of people. Instead of tanking, demand for bikes was soaring ... but there was precious little inventory on hand or in the pipeline to respond to it.

To compound matters even further, factories were often locked down due to COVID restrictions, and when those were eased, found themselves with a shortage of workers. Factory orders were being placed years in advance with volumes two to three times what they had been historically. And still retailers couldn't get enough bikes.

It was a new bike boom, many said, one to rival the mid-Sixties and early Seventies.

Except that it isn't.

A deep dive into the numbers

Record numbers of adult riders came into the activity in the first year of the pandemic, and those numbers stayed strong in the second year.

Record numbers of adult riders came into the activity in the first year of the pandemic, and those numbers stayed strong in the second year.

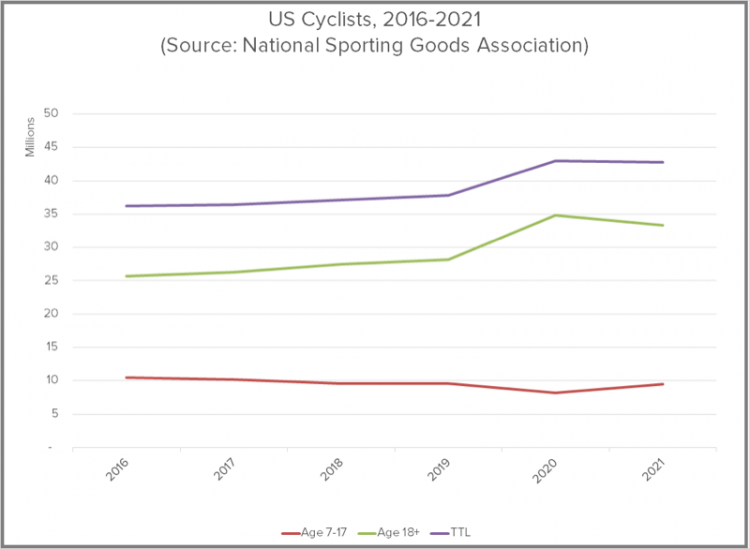

Let's start by looking at the actual influx of riders in the pandemic years, 2020 and 2021. There are a number of ways to measure this, but let's begin with the stats from the National Sporting Goods Association. Each year, the NSGA uses detailed consumer surveys to estimate the number of Americans over the age of six who have ridden a bike six or more times in the previous twelve months.

As you can see, the number of youth riders (red line, ages 7-17) had been trending down — a net loss of 8% between 2016 and 2019, according to the NSGA. The first pandemic year, 2020, brought the net loss to 21%. But the trend reversed itself in 2021, bringing youth ridership back to 2018 levels. So rather than a boom in young riders, we saw an increase back to historic norms, and even then, it didn't happen until the second year of the pandemic.

Adult riders (green line, 18 and over), on the other hand, had been steadily rising, with a net gain of just under 10% between 2016 and 2019. In 2020 there was a gain of 35% vs. 2016; that year also showed the largest adult ridership in decades (my data goes back to 2000), and those numbers stayed high but tapered slightly in 2021. So record numbers of adult riders came into the activity in the first year of the pandemic, and those numbers stayed strong in the second year.

The totals (purple line) are in line with the adult riders, trending up slightly 2016–2019, with a 19% boost in 2020 and almost flat in 2021 vs 2020.

PeopleForBikes also measures ridership, although its methods are different from the NSGA's, counting anyone of any age who rode a bike outdoors at all in a two-year sample period, and the result is measured relative to the U.S. population at large. It's difficult to compare the two sources, but both groups agree there was a significant upswing in ridership during the pandemic. In its special report, the Covid Participation Study (which includes indoor riding) PeopleForBikes had this to say about ridership during the pandemic:

As of late 2020, 30.1% of American adults rode a bicycle at least once within the past two years. During the COVID-19 pandemic, 4% of American adults rode a bike for the first time in over one year, or for the first time ever. An additional 6% participated in a different type of bicycling during the pandemic, such as trying indoor riding or riding their bike for transportation.

I reached out to PeopleForBikes' bicycle industry research manager, Patrick Hogan, for comment. "In addition to the 4% increase in ridership," he told me in an email exchange, "we also saw 6% of the U.S. population change the way they rode bikes, meaning that they switched from riding for recreation to riding on a trainer, for instance. So, more riders, riding more often, and riding more varied types of rides."

The Covid Participation Study also had some interesting things to say about where these new riders purchased their bikes, with only 29% buying from independent bicycle dealers. 28% purchased from mass market stores (Walmart, et al) and 25% from sporting goods stores (Dick's Sporting Goods, Academy, Big 5, et al). These percentages seem similar to where riders buy bikes in a normal (i.e., non-pandemic) year.

That was then, this is now, here's what's next

What happens to all those optimistic orders that were placed at the peak of the demand wave and are now finally going to ship in 2022 and beyond?

The bottom line is clear: we've seen an unprecedented upswing in riders in the past two years — in 2020 for adults and 2021 for youngsters. But the big question is how long those new riders will stick around and stay engaged in cycling (and continue buying new bikes and equipment and services from local bike shops). And the question behind that is whether the upswing represents a fundamental shift in how Americans relate to bicycles, or if it was purely a response to the Covid pandemic.

What happens to all those optimistic orders that were placed at the peak of the demand wave and are now finally going to ship in 2022 and beyond?

We won't have good data on the ridership question for another year, but there are some educated guesses we can make in the meantime.

Back in March, a BRAIN Reader Survey asked retail business owners about their first-quarter numbers for 2022. Out of nearly 250 responses, more than half (56%) said their sales were down versus 2021. An additional quarter (23%) said their numbers were flat versus the previous year. A similar survey on the Cycling Industry Recovery Facebook page yielded comparable results. Of course, neither source makes a pretense of being a controlled study like the NSGA or PeopleForBikes reports, but when three out of four respondents report their Q1 sales were down or flat, it's a strong indicator that the wave of new riders may have crested and may even be subsiding. And we're already seeing reports of dealers holding clearance sales to reduce inventory. Which brings us to a third question: what happens to all those optimistic orders that were placed at the peak of the demand wave and are now finally going to ship in 2022 and beyond?

For sure, some of those new riders will stick around. But overall, it seems ridership will tend to decline back to historic levels. And from the meager evidence available, that process is already started.

Meanwhile, a lot of dealers and suppliers have pushed huge stacks of chips to the center of the table, doubling down on the wave going strong for at least the next several years. But if the wave collapses on itself — which is, after all, what waves tend to do — there will be a huge oversupply of product in all stages of the pipeline. And you can't put that much toothpaste back in the tube: it will take years of aggressive discounting to clear all the surplus inventory from the channel. Which brings us back to the market and product conditions of 2011-2018, only more so.