We’ve just closed our second year of record COVID-driven bike sales, and the question everyone is asking is whether the boom will stay in place for 2022 or dial itself back to 2019 levels.

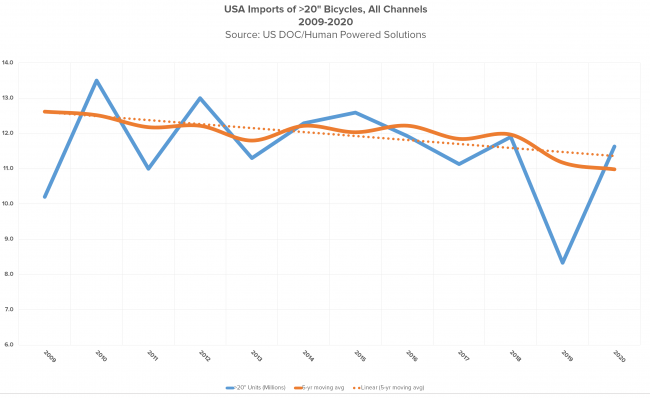

The premise alone is enough to cause confusion. 2019 was the worst year for bicycle imports since the ‘80s. Here’s a chart, below, showing imports (20” and above) over the decade-plus from 2009 (the Great Recession) through the last year for which we have data (2020). (Also, please note these figures do not include e-bikes, which the Department of Commerce tracks separately.)

As you can see, 2019 import levels were nowhere near the historical average. The only reason 2020 imports looked so good was in comparison to those miserable 2019 numbers … but at least the 2020 baseline is more in line with average imports.

The consensus of retailers I’ve spoken with across the country is that demand in the fall and winter months of 2021 was on par with historic averages. In other words, the COVID-induced demand bubble seems to be, if not popping, then at least subsiding.

The other thing we need to remember, as I wrote back in April, is that those “historically average import numbers” between 2010 and 2018 were all years when we had serious overstock problems, leading to season-long markdowns in an attempt to move all that surplus inventory. As an industry, we literally trained our clients not to buy at regular prices, but to wait a few months into the season to get substantial discounts.

What the experts are saying

Ray Keener’s article, What’s in store for us in 2022? in the current (January) issue of BRAIN, featured prognostications from a number of cycling industry experts. I recommend reading the entire article for context, but here are some excerpts from industry thought leaders:

“Dealers will be saddled with way too many high-end bikes in 2022, the result of late deliveries in 2021 and almost normal deliveries of 2022 models.” —Wayne D. Gray, VP, KHS Bicycles

“While the financial fallout will affect both the distribution and supply channels, the financial burden will fall particularly hard on bike shops and small to midsize retailers.”

—Jay Townley

“Larger retailers that ordered strong months ago are now starting to cut orders for fear of being overstocked. Unprecedented freight costs and logistics nightmares are driving inflationary retail pricing with no relief in sight. We anticipate this will negatively impact retail sales this spring, especially with entry-level bikes.” —Pat Hus, CEO, Bianchi USA

“As manufacturers continue to ship product and retailers fill up their depleted inventory levels, the normalizing of consumer interest in 2022 may leave us with excess inventory that we cannot immediately sell.” —Mike Cachat, Founder/CEO, Jenson USA

The final quote comes not from the article, but from my colleague Jay Townley’s Human Powered Solutions January newsletter. It’s long, but well worth the read:

“Absent a resurgence of consumer demand to at least 2021 first half levels, the probable inventory overhang in mid to low priced SKU’s will materialize, and the cascading effect will begin around February and spill into the distribution channels the end of the first quarter, just as interest rates will start increasing. Retailers will start reducing prices and will run sales to entice buyers and reduce inventory, followed by brands, who will also reduce and cancel orders with OEMs and ocean carriers. OEMs will reduce and cancel orders with component brands and manufacturers. While the financial fallout will affect both the distribution and supply channels, the financial burden will fall particularly hard on bike shops and small to midsize retailers.” —Jay Townley, Founding Partner & Resident Futurist, Human Powered Solutions

Now imagine what happens when factory orders are placed two years in advance, at more-than-historic volumes, with factories running at redline trying to keep up with demand that might or might not continue to exist. Some would say we’re setting the stage for an inventory surplus debacle.

As NBDA president Heather Mason said in the January issue of BRAIN: “A lot of retailers know that inventory is going to stay spotty so they’ve maxed out credit lines or even got bank loans to get a lot of bikes. It’s keeping a lot of people awake at night.”

As well it might.

There are two separate but related questions at work here. The first is what imports will look like in 2022. But the second — and more important — question is what consumer demand will actually be.

With respect to this second question, the consensus of retailers I’ve spoken with across the country is that demand in the fall and winter months of 2021 were on par with historic averages. In other words, the COVID-induced demand bubble seems to be, if not popping, then at least subsiding. s

The exception to this return to business as usual is in the e-bike category, where demand continues to be stronger than in past years. Which only makes sense because, along with the much smaller gravel and cargo bike segments, e-bikes are the only category where consumer interest continues to grow.

Finally, a little ray of bitter sunshine

Assuming the experts are right and 2022 becomes a year of overstock with subsequent price reductions to move excess product, there is still one small bit of good news. Starting in 2019, we’ve had three years in a row where bikes were not heavily marked down in response to excessive inventory. So consumers may no longer have the same expectation of evergreen discounts they had in 2010-2018. This, in turn, may make them more motivated to buy when they’re presented with reduced pricing than in years past.

At least it’s something to hope for.