(BRAIN) — Halfway into the Trump administration's 90-day grace period, U.S. retailers and suppliers are grappling with how to account for their increased import costs.

Most imported bike products are now subject to an additional 10% tariff since April when the administration announced its ”reciprocal” tariffs and then quickly reduced them to 10% for 90 days, a period that will expire around July 4. An exception to the delay applies to goods from China, which remain subject to an extra 145% tariffs on top of pre-existing tariffs and duties.

Those who import from China have mostly just paused imports. Goods from Taiwan, Vietnam, Malaysia and other major supplier nations are set to increase significantly after July 4, if the administration does not negotiate new trade agreements before then.

But for now at least, much of the industry is dealing with a 10% tariff increase that Trump has indicated might remain in place for the long term. On Wednesday Trump announced an agreement with the United Kingdom that preserves the 10% tariff on most U.K. imports, for example.

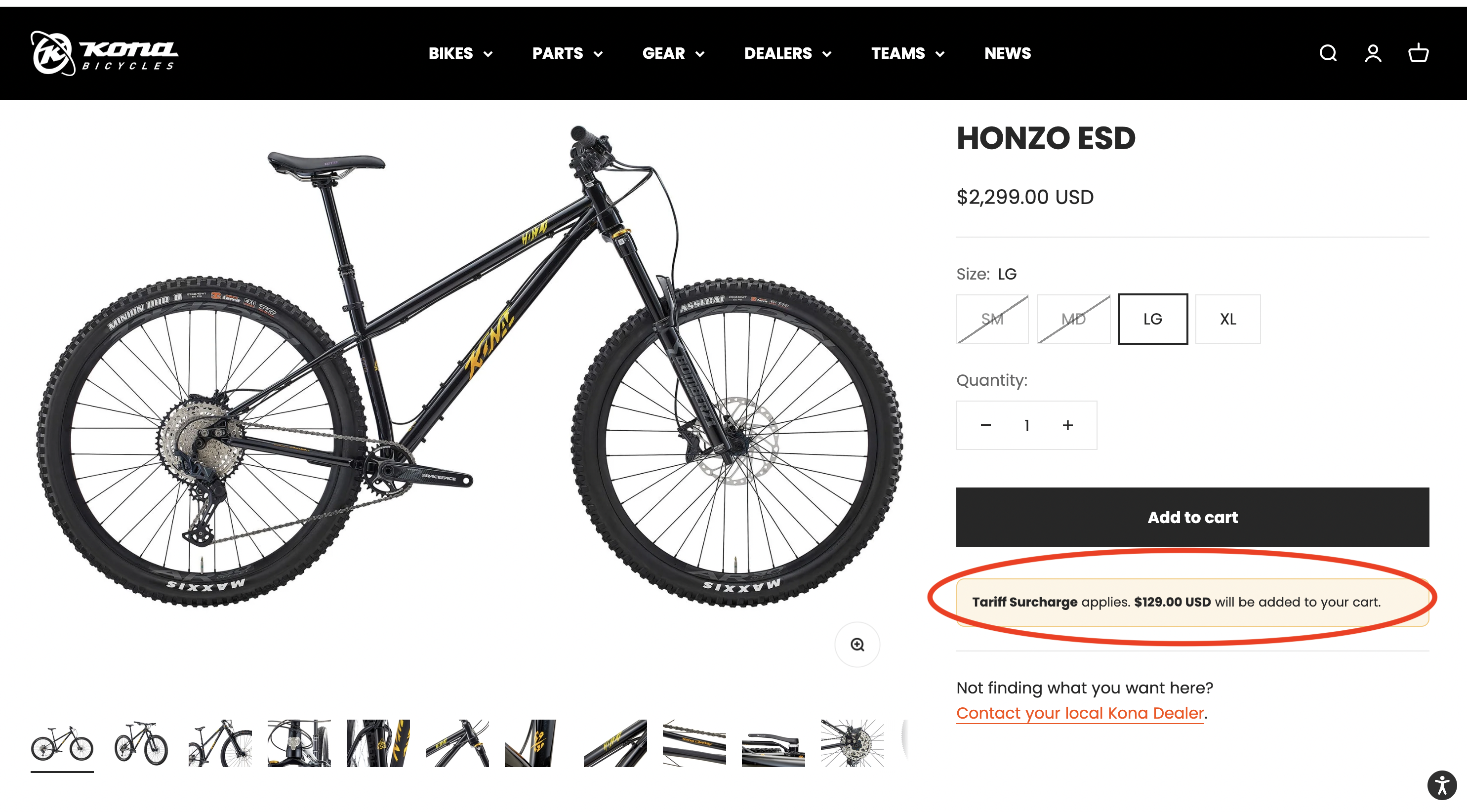

There are two distinct approaches: 1) Add a surcharge line to invoices and retail price tags and receipts, either by percentage or a flat amount. 2) Raise the wholesale price, the MSRP and the actual final price to account for the extra cost. Some suppliers and retailers are doing a little of both.

Specialized, for example, said it would add a 10% tariff surcharge to dealer invoices and D2C shopping carts on some e-bike models on May 1, and said it would adjust other prices by varying amounts. The company declined to talk to BRAIN about its policy. Its website currently shows $300 and $500 flat tariff surcharges on some Turbo Levo models, but doesn't show surcharges on other models.

Trek Bicycle announced that it would make price increases strategically on its bikes, apparently not adding a surcharge.

Kona Bikes has a tiered, flat surcharge, that increases on more expensive models. Ibis Cycles is one of the few bike brands applying a percentage surcharge, of 5% on most models, with variations of from 2% to 10% on some specific models.

Whether wholesalers adopt the surcharge model or the price-increase model, retailers still have the option of doing it either way. And some tell BRAIN they are discussing increased prices with curious customers even if they don't show the increase on the price tag or the receipt.

Advantages of Team Surcharge

- It makes a statement. “I want clarity on what's happening here. We need an informed population. We should call it a tax. That's exactly what it is: a tax on the American public,” said Mark Vautour, a regional manager for Landry’s, a Massachusetts retail chain.

- It's transparent. It makes it clear the brand and the retailer are not profiteering from the situation. Some feel that transparency mitigates the sticker shock of the new high final price.

- It can be strategic. Brands and retails can vary surcharges amounts to account for market demand or inventory levels.

- Easier to reverse or change. Some feel making the surcharge a separate fee makes it easier to remove or adjust it — up or down — if tariffs change, while maintaining a consistent MSRP. In notifying its dealers of its new surcharges, Specialized noted that going the surcharge route allowed it to “maintain flexibility to update or remove the charge if government tariffs change."

Disadvantages of Team Surcharge

- It makes a statement. One wholesale vendor that recently added a 10% surcharge said they did it in part to make a statement — but then asked not to be identified in this article because of possible repercussions. The vendor mentioned how White House press secretary Karoline Leavitt called Amazon “hostile and political” for even considering adding a tariff surcharge to products on its Haul discount site. “I don’t want to get a cease and desist from the White House,” the vendor joked.

- It’s technically and practically challenging.Some e-commerce platforms don’t allow retailers to add a surcharge. Even when it can be done, it requires the retailer (or consumer-direct vendor) to specify the amount (either a percentage or a flat amount) for each product, and then go in and change that if and when the tariffs change. On the retail sales floor, someone has to print out or hand-write new hangtags or price tags with the surcharge and then adjust as necessary. At the point-of-sale, some dealers add a new SKU to account for the surcharge. Then the dealer has to decide whether the SKU is a percentage increase or a flat amount and whether it varies by country of origin or vendor price.

Partly for technical reasons, Wahoo added a $50 surcharge in the form of an additional shipping fee to its new Chinese-made Radar accessory on its e-commerce site. "With the situation on tariffs rapidly changing, it is not practical to frequently update the Manufacturer's Suggested Retail Price (MSRP)," a Wahoo representative told BRAIN. "We have therefore made the decision to communicate a tariff surcharge throughout the customer journey and implement it on checkout. The charge is shown within the delivery price, described as an additional ‘service charge’ — which is compliant with the conditions of online shopping search engines and platforms.”

- The Math. Adding a precise surcharge by percentage could reveal the dealer’s exact cost to sharp-eyed consumers, confirming their suspicions that bike shops try to profit on sales. Adding a flat fee would be either above or below the actual extra cost, conflicting with the transparency message that the dealer is merely "passing through" the new cost.

- "Bait & switch” concerns. Posting a retail price and then an additional fee risks making some consumers feel they are being conned in the small print.

- Old stock. Another practical, technical and rhetorical concern: Should the seller add the new surcharge to inventory that arrived before the tariff was imposed? Some advise selling at a price that will pay for replacement inventory, but buyers don’t see it that way. “We are not increasing prices on stocks that we bought pre-tariff, for now,” said the owner of one parts brand that sells consumer-direct. “Of course, that’s a different argument, since at some point we need more money to buy new stocks at higher cost, so we can’t just keep charging the old, low prices,” they said.

Trek, in announcing its price increase to retailers last month, noted that the new higher MSRP would increase dealer margin on inventory purchased before the tariffs. “The value of your current inventory has just gone up, and moving forward, you will experience an increase in your GP (gross profit) dollars for bikes sold,” Trek noted. Trek also noted that back orders, placed before the tariffs took effect, would still be subject to its price increases.

- Google shopping. Many brands work to maintain stable retail prices in online shopping search results. If some retailers add a surcharge (instead of raising the MSRP), that risks presenting a wide array of prices in results, positioning the brand and some of its retailers as discounters. And complying with Google Shopping's rules for additional fees risks a mistake that could jeopardize a key channel.

As an aside: There’s no such thing as a “pass through.”

It may look transparent, but accounting for tariffs by adding a surcharge or a price increase that supposedly equates to the extra 10% does not make the seller whole. Because there are always additional costs. For example, if an e-bike has a $500 tariff surcharge fee, the seller, at the very least, is paying a credit card fee of up to 3-4% on the $500 added to the transaction. If the seller financed the inventory purchase, they might be paying 7.5% interest on that extra $500. Even if the seller and the consumer paid for everything in cash, there was an opportunity cost — that $500 could have bought other inventory or paid a staffer to work more hours. One retailer told BRAIN he asked a key vendor to account for transaction fees in setting the surcharge amount. He hasn't heard back.

Team Price Increase

Some suppliers and retailers are simply raising their prices to account for the new tariff costs, instead of adding a line-item surcharge.

Generally, this approach allows the wholesaler and retailer to capture margin on the complete price (although, since surcharges are rarely exactly the same as the tariff, theoretically a surcharge amount could be adjusted to provide dealer margin. But that would distract from the "transparency" aspect that is often touted as a major advantage of the surcharge approach).

Increasing the price and maintaining — or even increasing — margin is a good idea, some say. Even now. Maybe especially now.

"The thing that nobody is paying attention to is that consumers are being trained to believe prices are going up,” one wholesaler told BRAIN. “It’s an opportunity.”

Indeed a recent Gallup poll found 89% of Americans expect tariffs to cause price increases.

The risk to this approach is it could create the perception that the industry is trying to profit from the situation. Which is precisely why the supplier in question didn't want their name associated with the idea. It's not a good look outside the business community.

Nevertheless, they said, “It’s a great time for collaboration … dealers have been pinched for years. I’d like to encourage vendors to think about the value that retailers add, and, as they go through this process of thinking about pricing, think about restoring margins that have taken a hit over the years.”

As for the pros and cons of making a price increase, you can reverse most of those listed for Team Surcharge above. One thing is clear: either approach risks alienating a percentage of your customers, and at the end of the day, a price increase, no matter how it is implemented, is going to reduce sales. In this time of tariffs, most businesses are choosing from a long list of bad options.

Dean Yobbi contributed reporting to this article.