NEW YORK CITY (BRAIN) — If bike shoppers seemed particularly hard strapped for money this year, it could be because consumer debt hit a new high, higher than the lead up to 2008’s Great Recession.

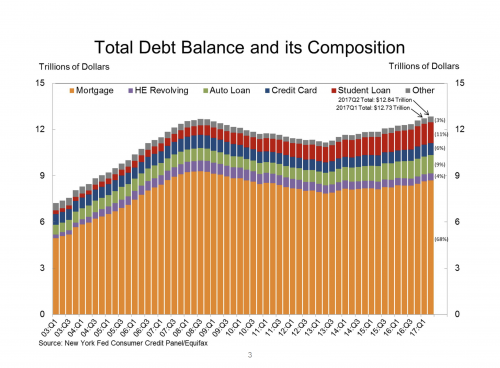

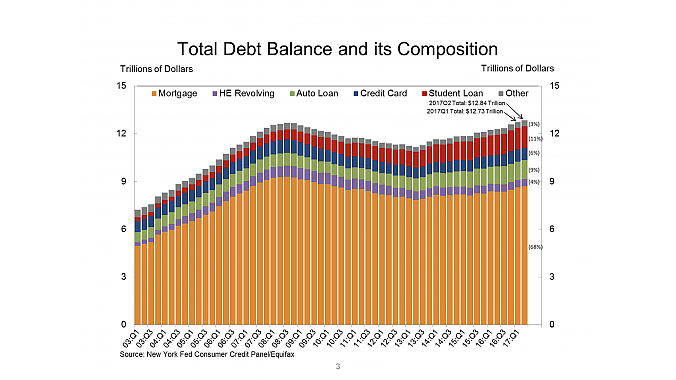

At the end of June consumer debt was $12.84 trillion, a $114 billion increase over debt in the first quarter this year, and $164 billion above peak personal debt in the third quarter of 2008 prior to the Great Recession, according to the Federal Reserve Bank of New York.

Auto and credit card debt are what continues to push consumers overall debt to historic levels. House loans also climbed but at less than half the increase of auto and car debt. Education debt and outstanding loans on home equity lines of credit declined slightly. The New York Bank report is based on nation wide surveys.

The report calls attention to increasing credit card late payment and delinquencies. “While relatively low, credit card delinquency flows climbed notably over the past year,” said Andrew Haughwout, senior vice president at the New York Fed in the report.

“The current state of credit card delinquency flows can be an early indicator of future trends and we will closely monitor the degree to which this uptick is predictive of further consumer distress,” he added.