BATH, United Kingdom (BRAIN) — The pandemic has brought millions of new cyclists into the sport, and how to retain those new customers is on the minds of many. But what about consumers who were cycling enthusiasts before the pandemic? How have their habits changed and what will they need from retailers and suppliers after this is all over?

Shift Active Media, a UK-based marketing and media company, recently surveyed over 4,000 cycling enthusiasts across Europe and North America about their new habits. Shift analyzed the data and its head of research, Doug Baker, wrote a 38-page report that was shared with BRAIN this week.

Overall, the data looks at:

- How the majority of cyclists plan to still keep buying products, looking at when and what

- The rise of indoor training

- The shift towards self-sufficient maintenance

- How cyclists are hungrier than ever to indulge their passion and consume cycling media in all its forms.

- The reminder that cycling supports mental health and allows us to connect with each other - and is not just focused on elite competitions.

For example, the survey found that only 12.1% of respondents said they "ride to compete" — a 56% drop from before the pandemic that was not surprising, given that most outdoor competitions this year have been canceled or postponed.

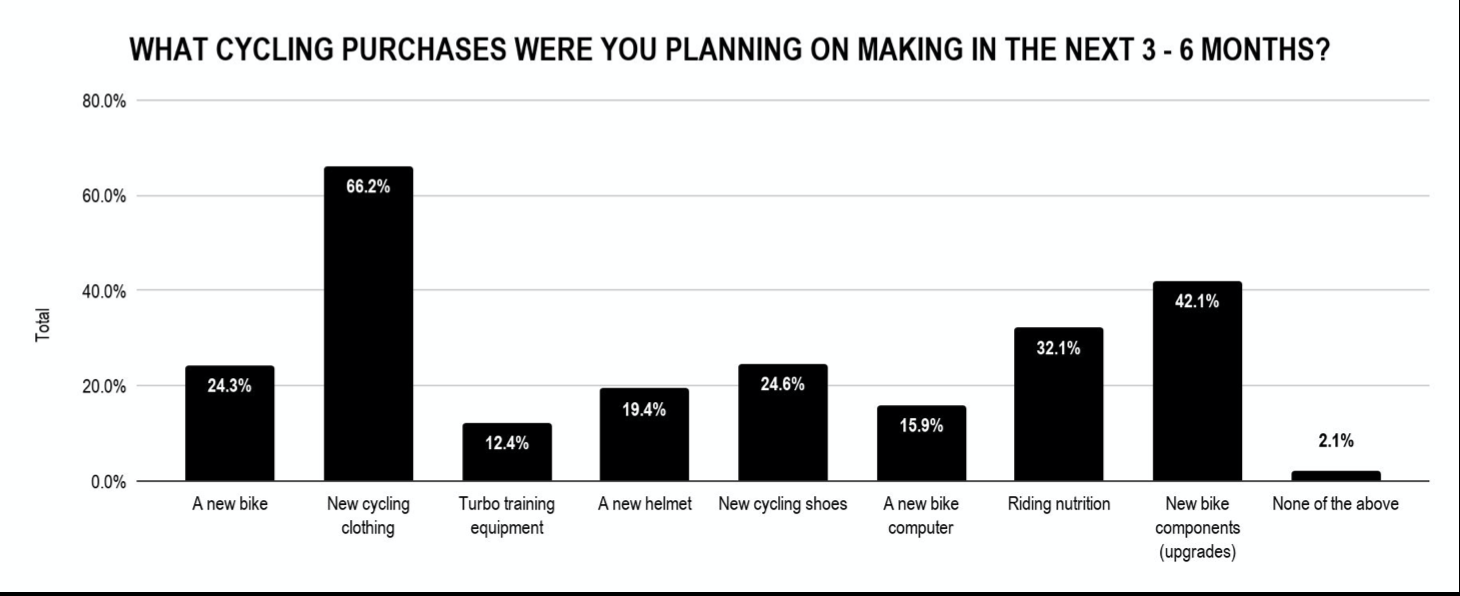

Enthusiasts are planning some big buys in the coming months, especially on cycling apparel and component upgrades, although almost a quarter of respondents said they plan to buy a new bike:

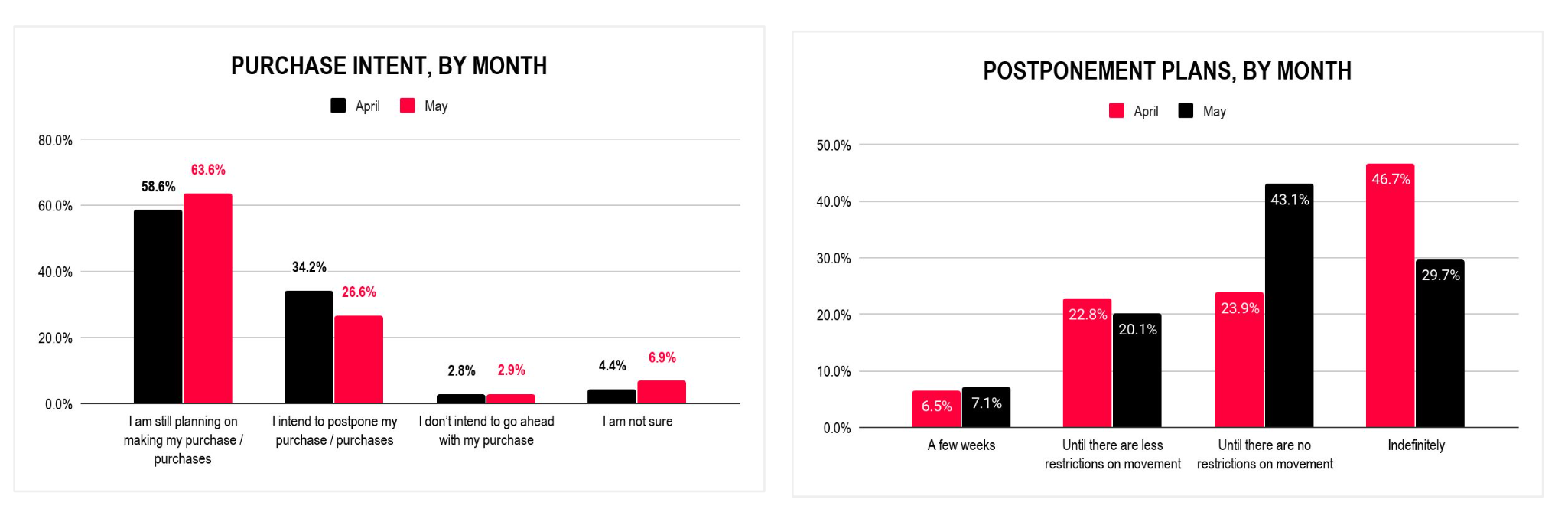

According to the study, most enthusiast cyclists plan to go ahead with previous purchase plans. "Amongst all those planning on making a cycling purchase in the next few months, only 3% have definitely decided not to make that purchase at all. With 6 in 10 saying they haven’t changed their purchase plans at all, and 3 in 10 planning to postpone, rather than cancel," the Shift report said. However, it could take a while before the cyclists act on their delayed purchase plans. Over a third said the delay was "indefinite," and more than half said they were waiting for a partial or complete lifting of cycling restrictions. This research was done globally, including European cyclists who experienced greater restrictions than in the U.S.

Not surprisingly, most riders who are planning to invest in indoor cycling equipment don't expect to delay that purchase very long — 70% of those buyers said they would put off a purchase by only a few weeks. Whereas, of those planning to buy a new bike, 59% said the delay would be only a few weeks, while 18.4% said they were postponing the bike purchase indefinitely.

When asked why they were postponing a purchase, most respondents cited a changed financial situation or — even more common — a general caution about spending in the current climate. Nearly 58% of respondents who are postponing purchases said their financial situation hadn't changed; they are just being more careful. Still, as the following graph shows, confidence about buying was on the increase as Europeans began to anticipate and end to lock-down restrictions.

Cyclists were increasing their consumption of cycling media, with around 40% of respondents saying they read or watched cycling content every day before the pandemic, but over 60% saying they did so during the pandemic lock-downs. Cyclists also were looking for more training advice, with a large increase in consumption of indoor training videos, in particular.

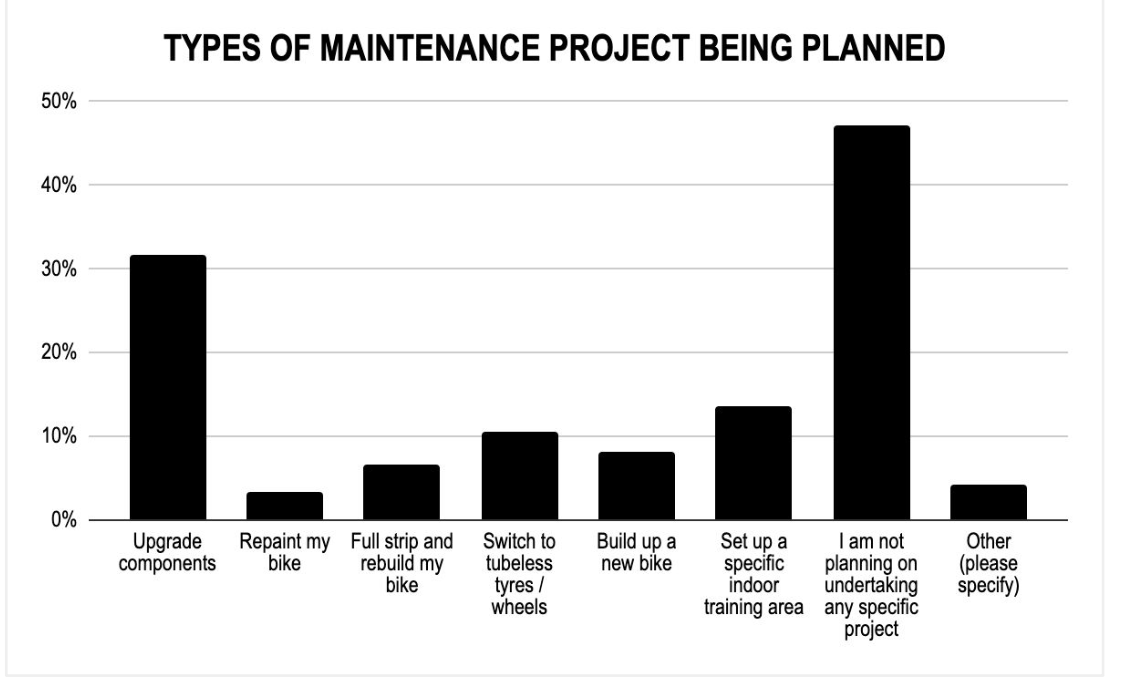

Cyclists are doing a bit more of their bike maintenance and service at home, versus at a bike shop, although the study found that as the lock-down continued, some riders were moving back toward having work done by shops. Many cyclists also planned of completed their own bike-related projects during the lockdowns: "Before the pandemic we see that just over half (53%) of all our respondents were planning some kind of maintenance or upgrade project. Upgrading components was the most common. But setting up an indoor training area was a very topical project. French cyclists were the most likely to upgrade their components (39%), whilst the Spanish and Japanese were most likely to be considering tubeless (19% and 17% respectively)," the study said.

Looking ahead, the study's author, Doug Baker, suggested that retailers and suppliers prepare to meet the "pent-up demand" from committed cyclists as the lockdowns ease. But the study suggests that flexibility is key. "While countries are slowly unfreezing now, the only guarantee is that things will continue to change. Many business planning cycles are too slow and pre-planned to deal with this. One thing this crisis has done is demonstrate which companies have the processes and mindset to evolve and adapt their plans as situations change. All companies should be reviewing not just their plans, but how they plan to better manage ongoing uncertainty," Baker wrote.

The study can be viewed at www.shiftactivemedia.com.