OSAKA, Japan (BRAIN) — Sales in Shimano’s bicycle-product division hit another record in 2022, reaching 517.4 million yen ($3.885 billion) up 16.6% from the year prior.

However, growth slowed significantly from 2021, when bike division sales were up 44% from 2020.

“Although the strong interest in bicycles during the COVID-19 pandemic showed signs of cooling down, demand for bicycles remained above the pre-COVID-19 levels. In terms of market inventories of completed bicycles, those of high-end class bicycles remained at a low level. Meanwhile, inventory levels of middle-class bicycles rose, following those of entry-class bicycles,” the company said.

Shimano's annual bike-division sales, in billions of yen:

2022: 517.4

2021: 443.7

2020: 297.8

2019: 290.0

2017: 270.2

2016: 259.5

2015: 314.0

2014: 274.0

2013: 217.3

2012: 198.2

2011: 177.3

2010: 169.4

2009: 144.7

2008: 185.9

2007: 157.8

Shimano said that in North America, market inventories “remained higher than appropriate levels due to the supply adjustment of completed bicycles.”

In its bicycle division, operating income was up 15.9% from the prior year, to 144,994 million yen.

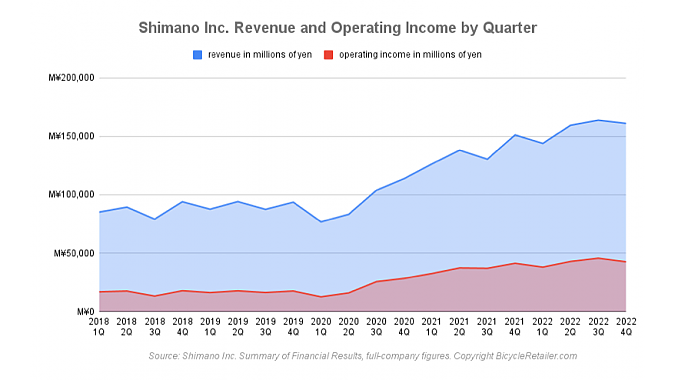

Company-wide sales were up 15.1% to 628.9 billion yen. In the fourth quarter, company-wide sales were 161 billion yen, up from 151 billion yen in the same quarter last year.

"During fiscal year 2022, while restrictions on activities to tackle the spread of the novel coronavirus (COVID-19) were eased, the outlook for the global economy remained uncertain due to soaring resource and commodity prices caused by the prolonged situation in Ukraine and monetary tightening measures aimed at curbing inflation taken by central banks in various countries, among other factors," Shimano said.

"In Europe, consumer sentiment was sluggish against a backdrop of concerns about resource and energy supply, rising prices, the prolonged high inflation and other factors, which increased fears of an economic slowdown.

In the U.S., while rises in policy rates to tame high inflation put downward pressure on economy, personal consumption remained firm backed by a solid employment environment.

In China, intermittent restrictions on economic activities under the zero-COVID policy slowed down a pickup in personal consumption, and economic recovery remained lackluster.

In Japan, rising prices caused by soaring resource prices and the depreciation of the yen put downward pressure on personal consumption, but signs of a gradual recovery in economy were seen as the normalization of economic activities progressed under the with-COVID policy.

In this environment, demand for bicycles and fishing tackle remained firm, although showing signs of cooling down, and for fiscal year 2022, net sales increased 15.1% from the previous year to 628,909 million yen. Operating income increased 14.1% to 169,158 million yen, ordinary income increased 15.7% to 176,568 million yen, and net income attributable to owners of parent increased 10.6% to 128,178 million yen."