ANOKA, Minn. (BRAIN) — Revelyst, the division of Vista Outdoor that contains its bicycle-related brands, is closing offices in four communities as it consolidates its related brands into three groups. Revelyst — which is expected to be spun off into a separate company soon — also said it would reduce its headcount as it eliminates "duplicative roles," but did not specify how many employees are being laid off. The company also said it will sell some "non-core" brands and is already talking to potential buyers.

Revelyst is closing offices in Petaluma, California; Overland Park, Kansas; Eagle, Colorado; and Madison, Mississippi. QuietKat, the e-bike brand that Vista Outdoor acquired in 2021, is based in Eagle; CamelBak is based in Petaluma; Bushnell is based in Overland Park; and Primos Hunting is based in Madison, Mississippi.

The company filed a WARN notice with California officials indicating that 43 jobs would be eliminated in Petaluma. A company spokesman said it would not release further information on the number of jobs affected.

QuietKat and CamelBak are being consolidated into Revelyst’s Adventure Sports division in Irvine, California. The Adventure Sports division includes Fox Racing, Bell Helmets, Giro Sport Design, CamelBak, QuietKat, Blackburn and other brands. The division is led by former Fox Racing CEO Jeff McGuane. The Bell and Giro brands, which had been based in Scotts Valley, California, were consolidated in Irvine last April.

“The decisions to close offices and reduce headcount aren’t taken lightly, and though they are intended to position us for the future, we understand that they are difficult in the immediate,” said Eric Nyman, the CEO of Revelyst, in a press release. “I have incredible confidence in our ability to transition through this and gain strength because of it."

“The decisions to close offices and reduce headcount aren’t taken lightly, and though they are intended to position us for the future, we understand that they are difficult in the immediate,” said Eric Nyman, the CEO of Revelyst, in a press release. “I have incredible confidence in our ability to transition through this and gain strength because of it."

Vista Outdoor plans to spin off Revelyst into a separate publicly traded company while Vista Outdoor’s other major division, which contains its ammunition brands, is expected to be sold to Czechoslovak Group after regulatory and stockholder approval.

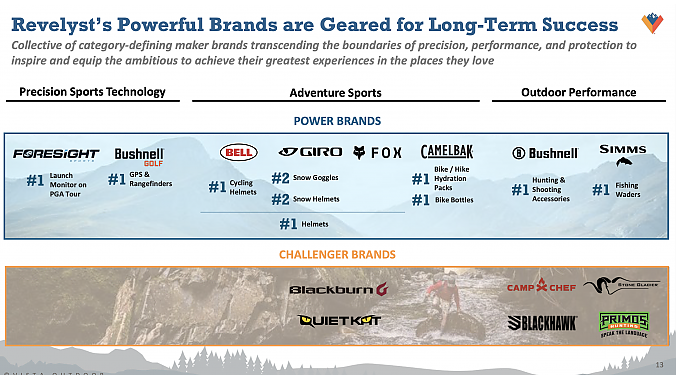

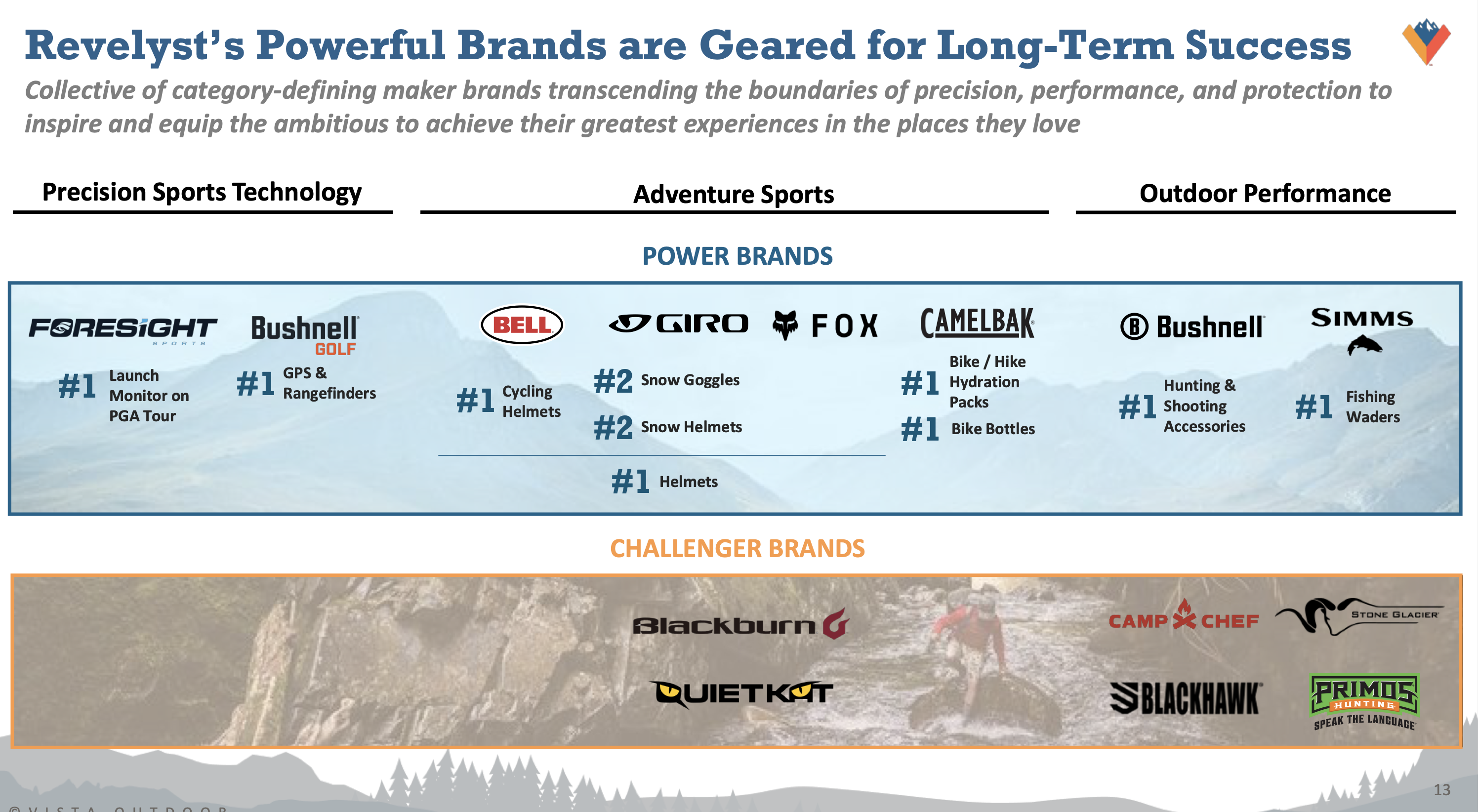

Revelyst now has three main business units, which it calls "platforms." Besides the Adventure Sports platform, the other two are:

- the Outdoor Performance group, which contains fishing and hunting-related brands and will be based in Bozeman, Montana, and

- the Precision Sports and Technology group, which contains Foresight Sports and Bushnell Golf and is being consolidated in San Diego.

Nyman, a former Hasbro executive who joined the company last summer, is leading a program called Gear Up to streamline the Revelyst brands and operations. Gear Up includes a strategic examination of its brands, separating them into "power brands" that will receive the most attention, and "challenger brands."

“Additionally, we are performing a strategic review of our brands and portfolio composition to assess core assets and focus on streamlining our brand portfolio into our Power Brand and Challenger Brand framework. Through this review, we have identified certain non-core assets as candidates for divestiture and have begun holding preliminary transaction discussions with various parties. These assets have garnered strong interest and the conversations have been progressing well,” he said.

According to a slide in an investor conference call Thursday (below right) the Adventure Sports platform power brands are Bell, Giro, Fox Racing and CamelBak. That platform's challenger brands are QuietKat and Blackburn. Lesser-known brands Raskullz, Co-Pilot and Krash are not on the slide.

None of the executives on the call said that the challenger brands are those that are being considered for divestiture. In 2018, Vista Outdoor announced that it hoped to sell Bell, Giro, and Blackburn, but a year later the company said it would retain them.

The Gear Up program is forecast to save the company $25-30 million in its next fiscal year and up to $100 million the following fiscal year.

On the conference call, CFO Andrew Keegan said that inventory challenges have improved in the Adventure Sports division, especially in the mass market channel. He said sales prospects are good in that channel and in Revelyst's growing consumer-direct channel. However he said the specialty channel still faces “a few headwinds” he did not specify.

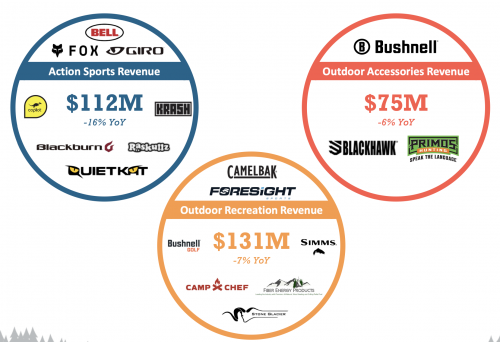

Vista Outdoor announced its quarterly earnings on Wednesday. The results showed that Revelyst sales overall were down 10%, while the Action Sports business unit, which contained the bike-related brands (minus CamelBak) under the previous brand organization scheme, had revenues of $112 million, down from $132 million in the same period last year.

On the conference call, executives said they expected Revelyst sales to return to growth in the fourth quarter of its fiscal 2024 (the current fiscal quarter, which began Dec. 25, 2023). They forecast that Revelyst will double its EBITDA in its fiscal 2025.