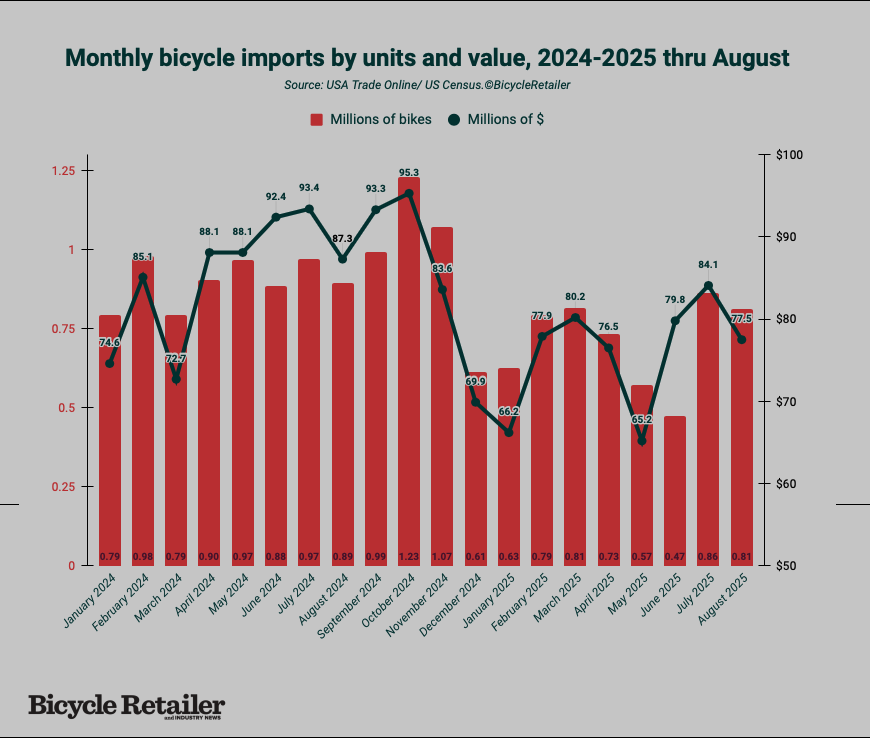

WASHINGTON (BRAIN) — U.S. bike imports from China rebounded in July and August, probably in anticipation of increased tariffs that were then threatened to take effect in November. Monthly bike imports this year have varied wildly in volume and country of origin as importers react to imposed and threatened tariffs as well as forecast consumer demand and industry inventory levels.

The government recently released August import figures, several months later than expected because of the government shutdown. The August figures are the most recent available and the U.S. Census has not announced its import data release schedule for the remainder of the year.

The August figures show the import rebound we reported in September continued. Before the rebound, U.S. bike imports, by value, reached a low point in May this year when the country brought in bikes valued at $65 million. By units, the low point was reached the following month when the country brought in less than 500,000 bikes — 46% fewer than the same month in 2024.

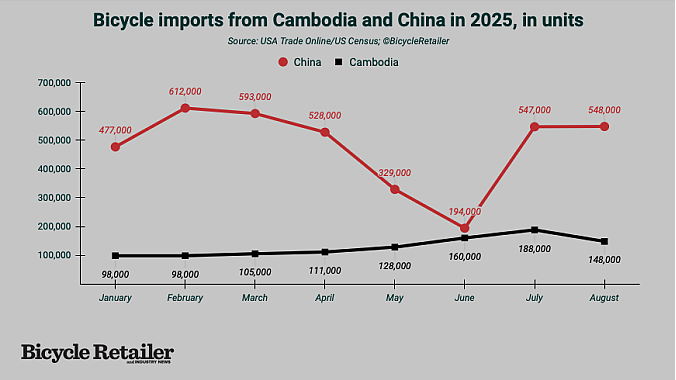

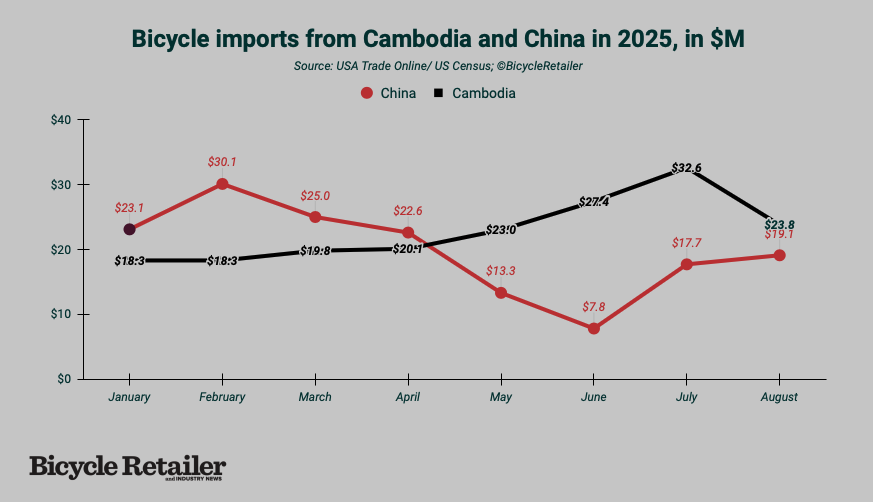

Imports from China came back the strongest. They declined sharply in the spring and early summer probably because the Trump administration had been threatening to impose new stiff tariffs on Chinese imports, starting on Aug. 12. However, on August 11 the administration announced something of a truce with China, leaving reciprocal tariff rates on Chinese imports at 10% until November. Although that rate was in addition to a 20% fentanyl tariff and Section 301 tariffs of up to 25%, the total tariffs on Chinese goods were much lower than feared, while reciprocal rates on imports from countries including Taiwan, Cambodia, India and Vietnam were higher than expected, making the cost differential between China and alternatives smaller than expected.

China passes Cambodia again

In June U.S. bike Imports from China had plummeted 42% YTD as the industry looked to Cambodia as a preferred alternative. Cambodia even passed China to become the largest supplier nation to the U.S. for the year through June — in dollar value.

In June U.S. bike Imports from China had plummeted 42% YTD as the industry looked to Cambodia as a preferred alternative. Cambodia even passed China to become the largest supplier nation to the U.S. for the year through June — in dollar value.

Through August, in dollar value Cambodia remained the largest supplier YTD, sending bikes valued at $204 million to the U.S., while China sent bikes worth only $159 million

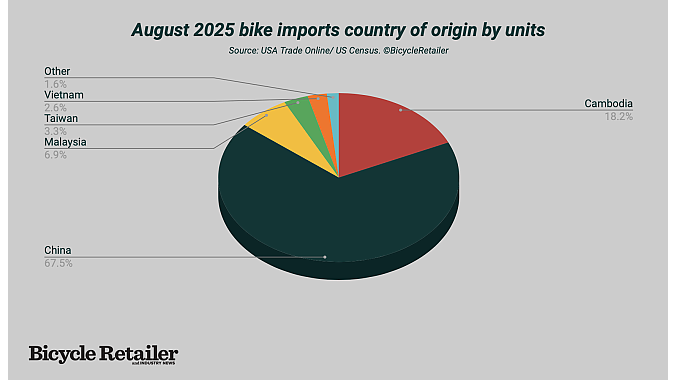

But in units, Cambodia never passed China in monthly imports and YTD through August, China imports totaled 3.8 million bikes to Cambodia's 1.0 million. (See the pie charts at the bottom of this page for the top exporting nations to the U.S. through August).

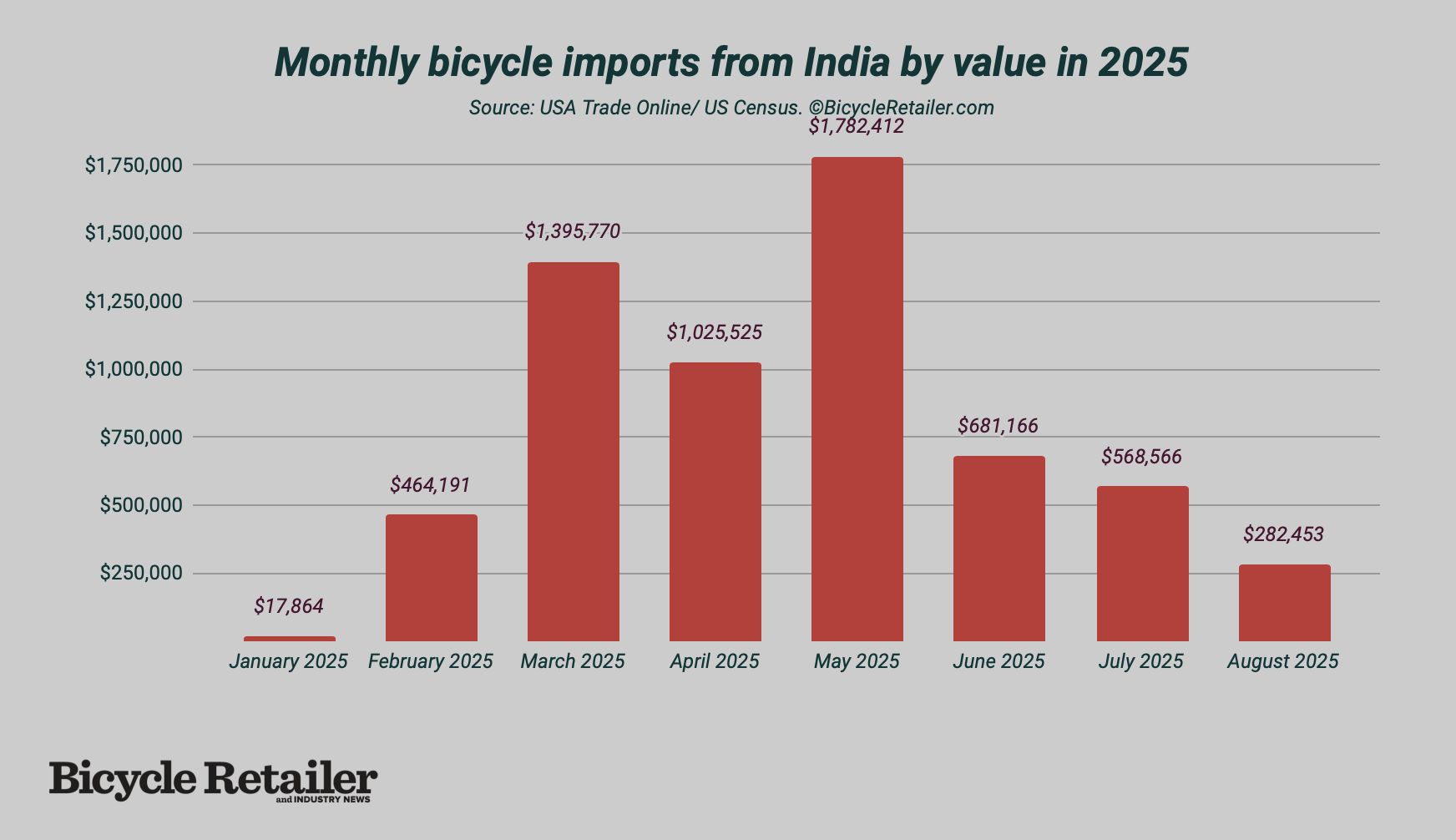

India imports dry up

Earlier this year the industry saw India as a potential alternative to China for inexpensive kids bikes, in particular. India is one of the world's largest bike makers by volume, but most of the country's bike factories are not currently configured to produce bikes to U.S. standards.

However, in August, the U.S. began imposing new tariffs of 50% on Indian imports, including a 25% tariff imposed because India continues to buy oil from Russia. That contributed to a huge falloff of industry purchases from India.

However, in August, the U.S. began imposing new tariffs of 50% on Indian imports, including a 25% tariff imposed because India continues to buy oil from Russia. That contributed to a huge falloff of industry purchases from India.