By Jay Townley

Editor's note: Townley is the Resident Futurist at Human Powered Solutions, an industry consultancy.

As an analyst and observer of the American bicycle market and business for the past 60 years, I began to ask how you can have a Bike Boom when U.S. imports of bicycles were "not exceptional"?

BRAIN published an article on Feb. 5 of this year in which it stated: "While sales and demand were exceptional in 2020, the import figures are not."

My question is actually very straightforward: The U.S. bicycle market and business, including pedal bikes and e-bikes is import-dependent, and has been for over 20 years. Therefore, as U.S. imports of bicycles and e-bikes go, so goes the market and business.

There is no question that American consumer demand for bicycles and e-bikes has dramatically increased from March 2020 forward, and most retailers, including bike shops, were sold out by summer — but a true bike boom, at least based on the four-year 1971 through 1974 Bike Boom, has to be more than just demand, it also has to have some positive demographic and social trends and supporting economics as well as supply-chain response to be sustainable. Let's take a look at some of the data that BRAIN published with the February 5 article.

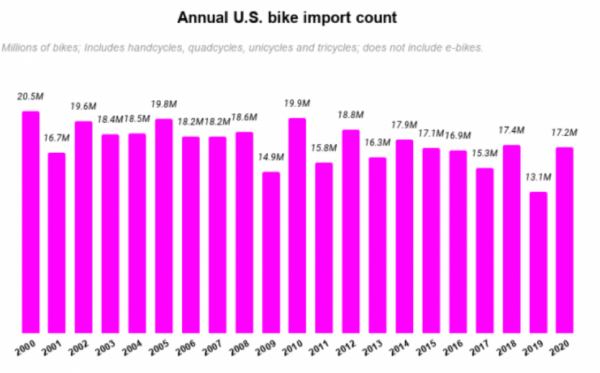

This chart is taken from the BRAIN article and matches the Annual U.S. Bike Unit Imports we have tracked for the same 21 years. The reason BRAIN commented that U.S. unit imports of bicycles were not exceptional is clearly shown in the totals for 2019 and 2020.

In 2019 13.1 million bicycles of all wheel sizes, excluding e-bikes were imported into the U.S., the lowest level of imports in two decades, with retail sales estimated at 16.5 million units of all wheel sizes, without e-bikes. Why? It seems obvious that the Section 301 punitive 25-percent tariffs were the driving factor. Importers and brands made a conscious decision to reduce their bicycle imports until the punitive tariffs, which added 25% to existing import tariffs, were either eliminated or suspended.

This decision, right or wrong, resulted in 4.3 million fewer bicycles in the channels of trade to meet the surge in consumer demand, and the supply chain has not been able to catch up, resulting in total imports of 17.2 million in 2020, down from 2018 by 200,000 units of all wheel sizes.

As we have said, since the year 2000 – for the past two decades – the U.S. bicycle market and business have been import dependent. The 21-year average for U.S. bicycle imports is 17.6 million pedal units of all wheel sizes, excluding e-bikes.

U.S. Bicycle Imports

2000-2019 Ranked by Unit Volume (in thousands)

|

Rank |

Year |

U.S. Bicycle Imports |

|

1 |

2000 |

20,473,848 |

|

2 |

2010 |

19,876,313 |

|

3 |

2005 |

19,803,531 |

|

4 |

2002 |

19,550,411 |

|

5 |

2012 |

18,758,260 |

|

6 |

2008 |

18,579,786 |

|

7 |

2004 |

18,490,477 |

|

8 |

2003 |

18,397,123 |

|

9 |

2007 |

18,233,438 |

|

10 |

2006 |

18,210,634 |

|

11 |

2014 |

17,897,807 |

|

12 |

2018 |

17,380,785 |

|

13 |

2020 |

17,237,711 |

|

14 |

2015 |

17,092,355 |

|

15 |

2016 |

16,896,252 |

|

16 |

2001 |

16,645,605 |

|

17 |

2013 |

16,261,629 |

|

18 |

2011 |

15,793,254 |

|

19 |

2017 |

15,350,145 |

|

20 |

2009 |

14,926,800 |

|

21 |

2019 |

13,065,950 |

Sources: U.S. Department of Commerce Import Statistics for 2000 to 2019

Human Powered Solutions analysis. NBDA U.S. Bicycle Market Overview 2019 Report

The table identified as number 28 has been taken from the NBDA U.S. Bicycle Market Overview 2019 report that is available to members. A nearly identical table was published by BRAIN with the article we are referring to. I used Table 28 because it was a clear image, and I was able to add 2020.

What this table does is present the same yearly import data, ranked by unit volume. Note that 2019 is at the bottom – an all-time low for the 21 years. BRAIN acknowledges that this is most probably because of the Section 301, 25% punitive tariffs imposed in Chinese imports as I have explained.

The bike shop channel of trade has been about 50% of retail revenue in the U.S. market and accordingly because of the high average retail and wholesale value, accounted for about the same percentage of inventory value held by retailers and their brand suppliers. Prior to 2019 bicycle brands offered very attractive terms to bicycle shops to take and hold as much inventory as possible.

The end-result of two decades of this supply chain distribution was the typical bicycle shop getting two inventory turns at maximum on new bicycle inventory annually. This served to locate a large percentage of inventory units and value at retail, but dramatically cut bicycle shop gross margin return on inventory, or GMROI, an important Key-Performance-Indicator or KPI. This in turn has resulted in the typical bicycle shop not realizing a net pre-tax profit on the sale of new bicycles in over fifteen-years. This all changed during the sales surge and inventory shortage of 2020.

The reduction of imports during 2019 to avoid paying the 25% punitive tariffs on Chinese-produced bicycles, which was and remains the source of the majority of bicycles imported into the U.S., was a calculated risk. On-hand inventory at brand warehouses and held by bicycle shops was dramatically reduced in the process of waiting to see if the tariffs were either eliminated or suspended during 2019.

In 2020 87% of bicycles imported into the U.S. originated in China. The 25% punitive tariff on imports from China, are on top of "regular" tariffs, and resulted in 25% on e-bikes, and 30.5 and 36% on regular bicycles. However, the anticipated exceptions were eventually granted the last day of December 2019 and were in force through all of 2020 and went back into full force and affect December 31, 2020.

This looked like a great bet for no more than the first four weeks of 2020. The Lunar New Year came in February 2020, along with the COVID-19 lockdowns and the anticipated ramp-up of bicycle production to replenish depleted inventory never happened in 2020 and still hasn't happened in 2021, with the end result that the U.S. channels of trade had 4.5 million fewer new pedal bicycles in 2020 to meet increased demand than they had prior to 2019.

Note that PeopleForBikes / Bicycle Wholesale Distributors Association (BWDA) discontinued publishing monthly "Sell-In" reports showing wholesale / brand sales of new bicycle units to bike shops and month-end on-hand wholesale / brand bicycle unit and value inventory in 2019 and going forward.

E-bikes

The situation with e-bikes over the same two decades is markedly different than the history of pedal or regular bicycles. Please note that import and sales data for e-bikes has been reported separately through 2019 and inclusively with pedal bicycles for the past year to 18 months.

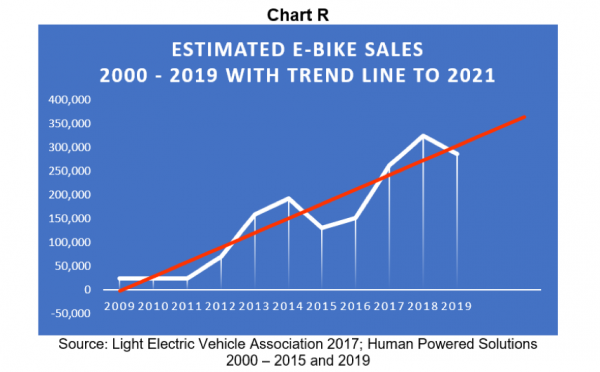

We rely on the e-bike import and sales data from LEVA and Ed Benjamin, as shown in this Chart R which has also been taken from the NBDA U.S. Bicycle Market Overview 2019 report.

The final 2020 e-bike import statistics are still being compiled, and there was a definite surge in retail sales last year, the estimated total is somewhere between 450,000 and 500,000.

What this chart shows is a reported decline to an estimated 285,000 e-bike units sold at retail in 2019, a decline from 2018, and a trend line showing a definite increase going forward – up to the level now estimated for 2020.

There is no question that e-bikes are and will grow as a major factor in the American bicycle business and market and this is absolutely a topic for future discussion.

To better understand the present-day sales surge and the 1971-1974 Bike Boom, a brief description of the defining trends that differentiate the two is appropriate.

Bicycle Advocacy 1955 through 1970

Dr. Paul Dudley White isn't mentioned or talked about much today, but he is viewed by most medical authorities as the founder of preventive cardiology. Dr. White was appointed as President Dwight D. Eisenhower's physician following his heart attack in September 1955, and he very publicly prescribed cycling for his famous patient, giving the bicycle industry a welcome boost that the Bicycle Institute of America (BIA) grabbed ahold of and promoted in the mass media for the next 15 years.

Dr. White become influential in getting Americans to focus on the benefits of exercise, diet and weight control and his advocacy for bicycling would lead to national advocacy through the BIA and League of American Bicyclists that influenced the emerging Baby Boom generation from 1955 through 1970.

During this 15-year period, American highways had improved and the Eisenhower Interstate Highway System had drained traffic from many of them, and new interest in recreational cycling was spurred by the promotion of sports bicycles with derailleur gearing by the Schwinn Bicycle Company and others.

The increasing awareness of the importance of physical fitness started by Dr. White and promoted by BIA and LAB also contributed to the popularity of bicycling.

"Nixon Shock" 1969 to August 1974

In January 1969 Richard M. Nixon took office as the 37th President. He was elected to a second term and served until his resignation in August 1974.

From a social standpoint Nixon ended the very unpopular Vietnam War and the Paris Peace Accords were signed in early 1973 ending U.S. involvement and shortly after the equally unpopular draft was eliminated. Both events had a positive effect on the population and particularly the emerging and influential Baby Boom generation. These events, while having a positive influence on the popularity of bicycling were minor compared to the major economic event of the Nixon years.

"Nixon Shock" is associated by economists with imposing Wage & Price Freezes from August 1971 through April 1974, when the enabling law lapsed. These are the years of the Bike Boom. Retail prices of new bicycles were "frozen" from mid-year 1971 through all of 1972, 1973, and the beginning of the second quarter 1974. Manufacturing and related wages were also "frozen." This was done to reduce inflation, and had a positive effect on consumer spending, including the purchase of bicycles.

Oil Embargo

In October 1973 a so-called Black Swan Event hit the U.S. economy in the form of the Yom Kippur War which broke out in the Middle East. An Oil Embargo was placed on shipments of crude oil from the Middle East to North America from October 1973 through March 1974 creating long lines at gas stations and the rationing of gasoline for cars and trucks.

As one publication of the time said, "...bicycles are selling like gas cans!"

After three years, 1971 to 1973 the Oil Embargo served to boost and extend the Bike Boom, shown in the Table titled U.S. Bicycle Boom 1971-1974, for another full year.

Explanation of the "Adult Market" demographics during the Bike Boom

The common impression today is that bike sales surged from 1971 through 1974 because adults suddenly became bicyclists. The bicycle industry became aware of the beginnings of a new market, defining an adult as anyone old enough to ride a 26 or 27-inch wheel multi-speed lightweight bicycle, which naturally included teenage segments of the population.

It is interesting to note that approximately ten years prior to the bicycle "boom" (1961 – 1964) one out of twenty bicycles were purchased by an adult, but during the period from 1971 through 1974, more than one-half of all sales were attributed to so-called "adult" cyclists.

It appears now that the national concern for physical fitness became a primary interest of adults during the 1971-1974 "boom," and led to the use of the bicycle, not only as a recreational device, but also as a health and fitness resource, obtainable at a relatively modest price.

U.S. Bicycle Boom

1971 – 1974

Imports, Domestic, Total 20-Inch Wheel & Larger Bicycles*

|

Year |

Imports |

Domestic |

Total |

|

1970 |

1,947,000 |

4,944,000 |

6,891,000 |

|

|

28% |

72% |

|

|

1971 |

2,339,000 |

6,510,000 |

8,849,000 |

|

|

26% |

74% |

|

|

1972 |

5,156,000 |

8,741,000 |

13,897,000 |

|

|

37% |

63% |

|

|

1973 |

5,155,000 |

10.055,000 |

15,210,000 |

|

|

34% |

56% |

|

|

1974 |

3,979,000 |

10,127,000 |

14,106,000 |

|

|

28% |

72% |

|

|

1975 |

1,718,000 |

5,576,000 |

7,294,000 |

|

|

24% |

76% |

|

Source: NBDA U.S. Bicycle Market Overview 2019 Report

*Does not include e-bikes, exercisers, frames.

In addition, environmentalists played a role in adopting the bike as an alternate mode of transportation, mainly because of the anti-pollution movement, as well as the bicycle's efficiency in commuting short distances.

The dramatic increase in "adult" style 26- and 27-inch wheel multi-speed bicycles is attributable in large part to youth riders in the 13 to 17-year-old segment of the population, graduation from the hi-rise bicycle to the sophisticated derailleur equipped lightweight bicycle. True "adults" in the 18 to 65 plus-year-old segment of the population also discovered the bicycle during the boom years – in growing numbers.

Why did the Bike Boom end?

As you can see in the table above, the Bike Boom did not end gradually. It ended with an abrupt 50% drop in market demand in one year, from 1974 to 1975, and it never reached the peak year of 1973 at 15.2 million 20-inch and larger wheel bicycles again.

The reason was simply market saturation. Over the four years from 1971 through 1974 the consumers that urgently wanted a bicycle purchased one – including those that wanted to have a bicycle just in case they couldn't get gas for their motorcycle, scooter or automobile, and the market demand went back to just about where it had been before the Bike Boom.

What are the differences between then and now?

In 1971 the there were nine American bicycle manufacturing companies holding 74% of the total market. They were members of a trade association, the Bicycle Manufacturers Association (BMA) that belonged to the Bicycle Industry Association (BIA) and paid dues, along with the dues of the other member trade associations that had been used for the prior 15 years to promote the teachings and bicycling advocacy of Dr. Paul Dudley White to the America public.

This isn't to say PeopleForBikes, and the League of American Bicyclists do not have aggressive advocacy and governmental affairs programs, but it is reminding us that the bicycle business had spent a substantial amount of money over many years getting the bicycling message to the public before the 1971-1974 Bike Boom.

Both the 1971-1974 Bike Boom and the current surge in demand for bicycles started with a solid base and long-term promotion of bicycling.

However, the 70's Bike Boom progressed into a positive economic environment that lowered inflation through wage and price controls — and was helped by a shift in favorable demographics and the ending a very unpopular war and the draft and which got a boost in the last of four years of the Boom by a Black-Swan event — an oil embargo and gas shortage!

The current 2020 – 2021 surge was started by a Black-Swan event, the COVID-19 pandemic, and gained momentum out of the fear people had of being exposed to crowds of people on public transportation and their desire to social distance while engaged in transportation and commuting, as well as being outside and getting exercise. The economy has been only partly helpful and there doesn't appear to be an underlying demographic boost beyond what existed pre-pandemic.

How does 2020 compare to the 1971 – 1974 Bike Boom?

Let's start by making sure we are comparing apples to apples. The table above for 1971 – 1974 clearly states that it reports 20-Inch wheel & larger bicycles. The data does not include juvenile bicycles, exercisers, frames or e-bikes. This is because the U.S. bicycle industry only collected and reported 20-Inch wheel & larger bicycles before, during and for many years after the Bike Boom.

On this basis we estimate 2020 totals below 1972. There is an argument to be made for adding e-bikes, and with the estimate from Ed Benjamin included 2020 still comes in below 1972, but certainly closer to the 13.9 million 20-Inch wheel larger units.

I have been told that I should be using retail dollars, and on this basis, there is no question that 2020 will exceed the best years of the 1970's Bike Boom. But retail dollars really must be adjusted for inflation and they also include price increases passed through the channels of trade from their respective supply chains, and the comparative data isn't available going back to the Bike Boom, so units is the best way to compare.

Summary

I am not saying 2020 was not an extraordinary year for the American bicycle business, because it was. What I am questioning is declaring what happened in an extraordinary year a Bike Boom, which may be too simple an explanation, and dangerous from the standpoint of how it will most probably end, and what the post-pandemic period will hold for the bicycle business.

Keeping in mind that North America is definitely not Europe, and what has happened in that market has not been and will not be duplicated per se in America is an important consideration going forward, particularly as concerns ebikes, which have a very bright, but different future in the American market.

I was also recently reminded by Joe Marcoux of something Peter Drucker warned American business about:

"The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday's logic."

With that said, here are the HPS predictions for 2021 and 2022:

- 2021 will be a lot like 2020 as the country struggles to get the COVID crisis under control and bicycle retail sales will remain strong, but the supply chain will not increase the availability of "on-demand" inventory as prices rise through 2021.

- The climate crisis, sustainability and environmental responsibility will become increasingly influential and important to the bicycle business as "green" becomes the color of recovery – and weather plays a growing role in everything!

- 2022 will see COVID under control and America opening-up to a new reality, with mixed economic recovery, pandemic-induced changes in shopping behavior, supply chain rebalancing – and the demand bubble-popping as on demand inventory builds, price wars drive the bicycle market and business – and IBD's have a GMRO opportunity!

- Sustainability – by 2022 will be part of the cost of entry – as the American bicycle and ebike market finds a new "net-gain" level...

HPS is a unique consultancy focusing on product development, sourcing, logistics and operations for its clients in human transportation and micromobility. To learn more visit humanpoweredsolutions.com.