Editor's note: A version of this story appeared in the June 15 issue of Bicycle Retailer & Industry News. We are republishing it because of interest in our story published today about bike tax receipts in Oregon.

COLORADO SPRINGS, Colo. (BRAIN) — Each time retailer Nick Ponsor looks out from his store’s new café, he sees a bike path that owes at least part of its existence to a bike tax his store and others here have been collecting since 1988.

Ponsor‘s Criterium Bike Shop is on one of the city’s major paths, making the café, which opened just before Memorial Day weekend, a sure bet.

“This path goes for about 40 miles, and all that way there is nothing except for this,” he said. “So now people don’t have to wander off the trail to go to a coffee shop or restaurant.”

Colorado Springs’ $4-per-bike sales tax has brought in an estimated $2.3 million since it was enacted, all earmarked for use on bike infrastructure like the path outside Ponsor’s shop.

“Once we explain to customers what it’s for, 99.9 percent of people are fine with it. … As far as I know the money is going where it’s supposed to go. Without it, it would be hard to fund some of the new stuff getting done around here.“

The tax applies to bikes with wheels larger than 14 inches — including those sold in big-box stores.

As the rest of the country eyes Oregon’s new bike tax — the only state bike tax — it’s worth a quick look at two smaller-scale but long-standing programs, in Colorado Springs and Hawaii.

Hawaii's fee

Hawaii charges a $15 new bike registration fee. Although technically not a tax, it is collected by retailers and burdens them more than a simple tax would. On the other hand, Hawaii probably has more registered bikes than anywhere in the country. While other communities around the country have bike registration programs, few have been as successful as Hawaii's.

Retailers get bike buyers to fill out cards with the bike’s serial number and description. The fee is rung up with the sale, and stores mail or deliver the cards, and typed copies of the information, to the county each month.

“It is a time-consuming hassle, but we’ve been doing it so long it just becomes our routine,” said Jane Kim, the owner of Eki Cyclery in Honolulu.

The program helps recover stolen bikes.

“We’ve seen at least a dozen bikes get recovered because of it,” Kim said.

It also brings in about $600,000 annually to Honolulu County, the largest in the state. All retailers, including big-box stores, collect the fee, which applies to bikes with wheels larger than 20 inches.

The Hawaii Bicycling League gets grants from the fund to run youth and adult bike education programs, said Daniel Alexander, the organization’s advocacy director.

“In general, adding to the price of a bicycle is a bad thing because it discourages bicycling. But I think it’s been in existence so long that we all accept it and I haven’t seen any efforts to eliminate it,” Alexander said.

Oregon's tax

Oregon retailers began collected their $15 tax on Jan. 1. It initially applied only to bikes with wheels 26 inches or larger and selling for more than $200. E-bikes were exempt. As of June 2, the tax applies to all wheel sizes and e-bikes. The $200 minimum remains.

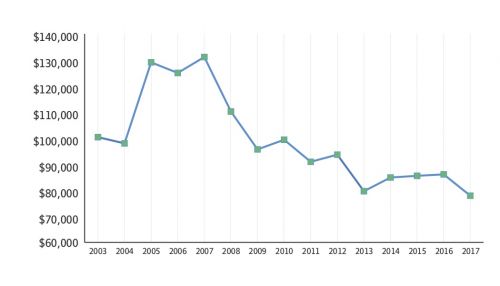

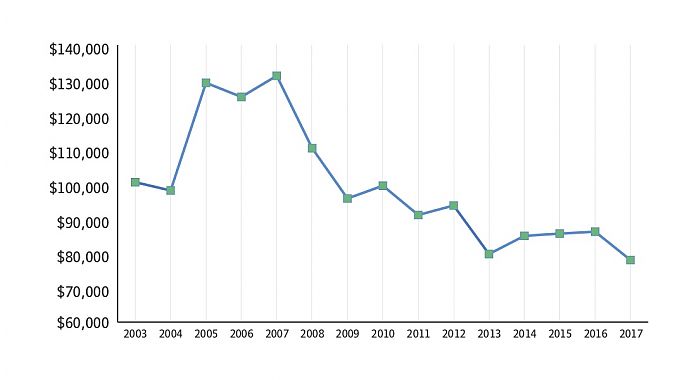

Retailers have to remit their tax payments to the state quarterly, and in May Oregon released its first report of receipts: just $34,000 (through August, the state collected about $290,000). The number is deceptive because it represents only the first-quarter receipts the state took in April. As retailers (and their accountants) learn the system, the quarterly receipts are expected to increase significantly. Lawmakers predicted the tax would bring in $1.2 million its first year.

Retailers have to remit their tax payments to the state quarterly, and in May Oregon released its first report of receipts: just $34,000 (through August, the state collected about $290,000). The number is deceptive because it represents only the first-quarter receipts the state took in April. As retailers (and their accountants) learn the system, the quarterly receipts are expected to increase significantly. Lawmakers predicted the tax would bring in $1.2 million its first year.

One store that paid on time was Sellwood Cycle Repair in Portland.

“It has been a talking point,” said Sellwood’s owner, Erik Tonkin. “Ultimately, it's something that many customers seem to be annoyed by, but then accept.”

As in Colorado Springs and Hawaii, proceeds are earmarked for bicycle projects. Tonkin’s main objection is that the $200 minimum keeps big-box stores from paying their share.

“A lot of bike sales come from those retailers. If we're serious about this tax, then it should be comprehensively exacted,” he said.