BOULDER, Colo. (BRAIN) — Ahhh, spring in bike retail! Our Southern-tier states, with warmer and more reliable weather, ramp up in January, while their Northern-tier counterparts wait and hope. March, April, May, when will the season kick off? And if the season opens slowly, how much ground can you make up later on?

That's been the reliable pattern for decades. With pandemic pandemonium pummeling and propelling the industry for the past two years, we now have massive uncertainty around both supply and demand.

In hopes of giving the Northern shops some insight about how to prepare, we surveyed 2,000 shops in the 15 states that are south of the "60 degrees in March" line. We asked about their January and February sales.

In an unprecedented example of industry cooperation, the National Bicycle Dealers Association, SmartEtailing and Georger Data Services collaborated to distribute BRAIN's three-question survey Feb. 28. Patrick Hogan, the bicycle industry research manager at PeopleForBikes, helped craft and simplify the survey to improve the response rate and clarity of results.

We asked Southern retailers to compare their sales in January and February 2022 to the same months in 2021 in nine product categories:

- Apparel

- Bicycles, all types

- City/commute bikes

- Electric bikes

- Kids/BMX bikes

- Mountain bikes

- Road bikes

- Parts/accessories/rubber

- Service/repair

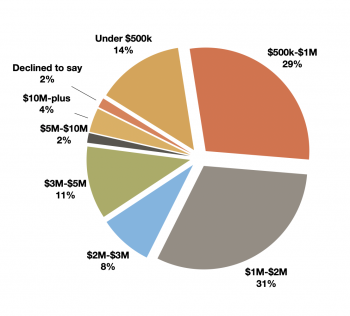

We also asked them to share their 2021 overall sales in revenue categories ranging from under $500,000 to over $10 million. This will allow us to cross-tabulate the product category results based on store size in the April print edition of Bicycle Retailer & Industry News.

Incidentally, while weather is not the only factor impacting sales, January temperatures in the 15 states surveyed were typical, although California — where 25% of the votes came from — was slightly warmer than average in January. (February data is not yet available).

This methodology sounds impressive, but we must caution that it is flawed in three ways. First, it's an opt-in survey rather than a survey of representative of U.S. bike retailers. We received 136 responses, or 7% of those we surveyed. It would be a sufficient sample to draw conclusions if we knew they were representative, but as an opt-in, there's a larger margin of error.

Second, while the Georger Data Services list of about 6,500 shops nationwide is comprehensive, both the NBDA and SmartEtailing lists skew toward higher revenue shops.

The biggest shortcoming of our process: There's no way to separate consumer demand from retailer inventories. For example, road bikes look pretty bad. Some 38% of Southern-tier shops report that their road bike sales are "down a lot" from 2021. Is that due to inadequate supply, or waning demand? We can't really say.

OK, enough with the caveats. While there are some significant trends identified by the survey, we consider them "weak indicators" of the state of the U.S. bike market in the first two months of 2022. Glean what you will, but don't take this to the bank. Your banker may have taken a stats class somewhere along the line.

BIKE SALES

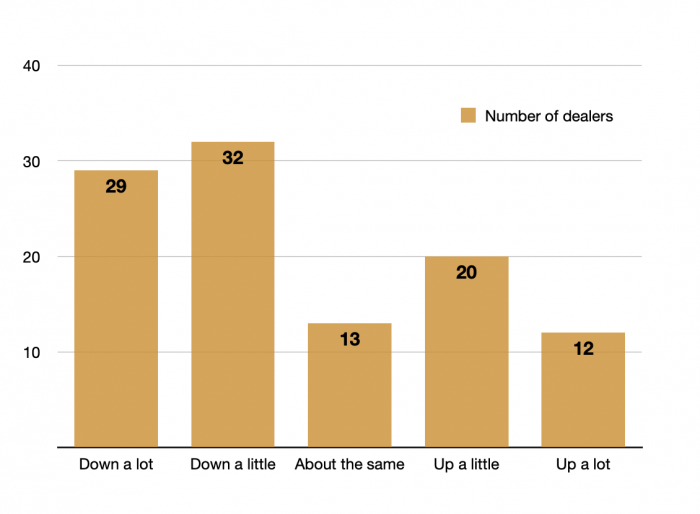

This is the big one for all concerned. The survey shows as you can see from the graph below that demand for bikes across the board is down slightly from 2021.

STRONG CATEGORIES

No surprise here, e-bikes and service/repair are the only categories that show gains. On e-bikes, 40% of respondents said they saw at least a little gain over 2021 sales. On service/repair, 47% said they saw at least a little gain.

No doubt these would be even stronger if we had enough e-bikes and enough mechanics.

WEAK CATEGORIES

Apparel, kids bikes and road bikes are in decline compared to 2021, retailers said. On apparel, 48% were down a little or a lot. On kids bikes, it was 39%, and on road bikes, it was 51%.

Apparel and kids bikes are likely less impacted by inventory shortages than road bikes, so these first two may be clearer indicators of a decline in demand.

HOLDING THEIR OWN

City/commute bikes, mountain bikes and parts/accessories/rubber don't show any significant change from 2021. Dealers who reported sales were "about the same" in those categories: 21%, 23% and 31%.

Mountain bikes provide an interesting opportunity to look more closely at results. While 47% of responders who sell mountain bikes say the category is down a little or a lot, 25% say the category is up.

ANOTHER PERSPECTIVE

We close with insights from Ryan Atkinson, the president and co-owner of SmartEtailing. Atkinson has a clear cross-brand view of industry sales trends and website usage. His team analyzes sales data from over 1,600 store locations to share with PeopleForBikes for their weekly Business Intelligence Hub reports.

"The BRAIN dealer survey results mirror what we see in our data — there is a significant swing in individual retailer sales performance," Atkinson told us. "That's my big takeaway when I see these survey results."

"First quarter 2021 was so strong that we find year-over-year comparisons in January and February challenging to interpret. I can say that so far the aggregate market performance this year is consistent with how 2021 ended. There isn't anything abnormal about how the winter season is progressing from an overall sales standpoint."

"We consider website visitors to be a leading indicator for purchasing. While January and February numbers are lower than last year, they are roughly 16% higher than early 2020 numbers. Website conversion rates are however holding steady at 2021 levels. Considering these measures in conjunction, they signal that there is strong consumer interest and intent."

Thanks to SmartEtailing, Heather Mason and Rachelle Schouten from the NBDA and Christopher Georger of Georger Data Services. And special thanks to the 136 retailers who responded to the survey to help their colleagues up North see what's coming. Maybe. Watch for more insights in the April print edition of BRAIN.