SARATOGA SPRINGS, NY (BRAIN) — Divine Cycling Group is less than a year old but seems to have produced more gray hairs across the industry than a teenager. On Thursday the group announced some more major changes as it tries to get its footing after a tumultuous summer

Divine Cycling Group Inc. (DCG) was formed to roll up a handful of small bike industry companies into an entity that would enjoy the efficiencies and increased institutional financing of larger brands. Its first acquisition was the Mad Fiber wheel brand in February; then in June DCG announced it had merged Mad Fiber with the nearly 40-year-old brand Serotta and the young bike brand Blue Competition Cycles.

Among the news coming to light this week:

- Despite announcing the merger in June, DCG principals say they never completed the merger of Blue Competition Cycles. DCG director Brian Case said the group has "no interest" in the company.

- Blue's CEO, industry veteran Steven Harad, says the company will shut down if it doesn't find an investor or buyer by Friday. He said Blue has $1 million in inventory — 2014 model year bikes — unpaid for and "sitting on a dock in Asia."

- Blue Competition Cycles remains owned by Lake Rudd Capital, which bought the brand from its founders late last year. Lake Rudd principal Bill Overbay has not returned calls from BRAIN seeking comment; Case said he is not in contact with Overbay.

- An amateur women's cycling team says its members paid $22,000 in deposits on an order for frames and bikes from Blue that were never delivered. Harad said he is aware of the dispute but can't comment on it.

- Serotta is being "bifurcated." The brand name will remain the property of DCG. But its upstate manufacturing facility is being renamed Saratoga Frameworks, and is now owned by Bradway Capital, the company that bought Serotta last year. Case, Bradway's managing partner, is overseeing the facility, which is being run by the same team that has been in place for years; Case also remains a director of DCG.

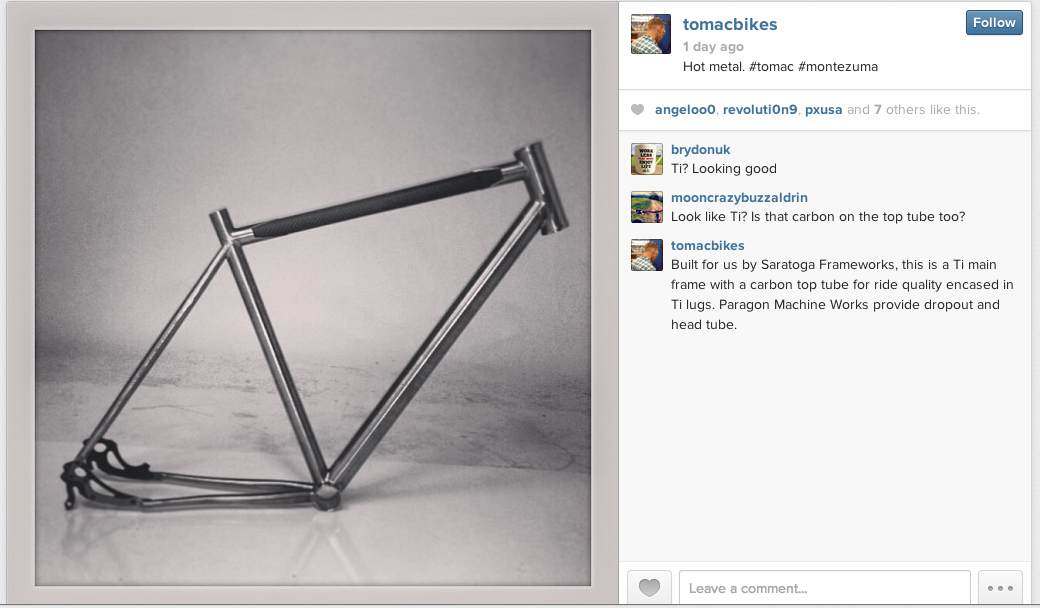

- Saratoga Frameworks has its first contract framebuilding customer: Planet X, which has hired the company to make a prototype Tomac-branded gravel grinder bike.

- Case said the Serotta brand might eventually be sold or otherwise commercialized, but for now it needs to "cool off."

- Mad Fiber is continuing to produce wheels in Seattle with a reduced workforce.

- Ben Serotta, whom Case fired last month from the company he founded 40 years ago — told BRAIN that he expects to announce news about his next career step later this week.

- Finally, Case said that he and DCG founder Dan Divine are currently too focused on managing their existing ongoing brands — Mad Fiber, Serotta and Saratoga Frameworks — to resume DCG's original business plan immediately.

Serotta dealers were told some of this news in a letter from Case sent out Thursday morning.

Some details of the developments at the various brands involved:

Blue Competition Cycles

When Lake Rudd bought Blue last December from founders Michael and Jay Skop, Lake Rudd's Overbay said, "Blue is a brand that we see becoming the next leading company across several segments of the growing cycling industry."

Lake Rudd is a private equity firm based in Rhode Island.

Blue CEO Harad started with the brand as a consultant prior to the acquisition. He said he's proud of what's been accomplished at the small brand.

"We took a brand that was more or less dead, and in nine months now we're ready to go. We've got staff, an office, a warehouse. We've lined up new factories, we built great bikes for 2014 and even better bikes for 2014 1/2 and 2015. We've got three new models ready to go."

Harad is an industry veteran who has worked for ASI's Kestrel and Oval Concepts brands and for Threshold Sports, the producer of the Pro Cycling Tour.

Blue now has a staff of five, and Harad said the company had been forced to sell off some equipment and lay off one employee to stay in business as long as it has. But he said unless a bailout is found very soon, he will be forced to shutter the doors and walk away.

'I'm staying on to the bitter end, but at this point it's kind of a Hail Mary situation looking for a buyer or an investor," he said.

DCG's Case said Blue never merged with the other two brands.

"Our position is that the acquisition of Blue never closed," Case said. "The transaction between Mad Fiber and Serotta was completed; both parties did what they said they were going to do. Blue did not."

Case said the uncertainty over Blue's contribution to DCG "led to most of the troubles, if not all of them. It created a dysfunctional team that was trying to serve three companies. It was a distraction and made it impossible to act on the DCG business model."

"Our position is that the acquisition of Blue never closed" — Brian Case

Case indicated that despite the dispute with Overbay, Harad had earned his respect.

"We have no interest in Blue at this point, except that personally, professionally, we'd like to support Steve as a good industry person who we would like to help."

Harad said he was aware that an amateur women's cycling team was in dispute with Blue over the delivery of bikes and frames but said he could not comment on the situation.

Marni Harker, a Washington, D.C.-area cyclist, told BRAIN that Team Kenda had placed $22,000 in deposits on an order with Blue last year, with delivery expected in early 2013.

After many delays, the team members cancelled the order on Aug. 1, but has not been able to get a refund from Blue. Harker said she and other team members had communicated with Overbay, who told her the problem would be taken care of, but then he stopped returning calls and emails. "He even took down his Twitter account," Harker said.

Team Kenda members also have communicated with Blue about the issue via Blue's Facebook page. In a conversation on the page as of Wednesday night, someone posting from the Blue Competition Cycles account told Harker, "Lots to this story but our new owner wasn't very honest and stuck us all with debt. It's not Devine [sic]."

Serotta and Saratoga

Case announced last month that Serotta would look to contract framebuilding as a stabilizing force.

"Contract manufacturing may represent a significant profit opportunity for the company, which in turn supports the future of the Serotta brand," Case said in a letter to dealers.

On Wednesday, he indicated he expects contract manufacturing to support itself, while the Serotta brand "cools off."

Bradway Capital acquired Serotta's factory from DCG, and has renamed the business Saratoga Frameworks. Case said he's been able to rehire some of the workers who were laid off earlier in the summer. (Related resource: Saratoga's press release)

He said the contract to build the Tomac bike for Planet X was particularly satisfying because it brings work back to the U.S. that might otherwise have gone overseas.

Serotta's troubles over the years stemmed from its business model, which remained focused on super high-end sales even after the economic collapse of 2008, Case said.

"Serotta's troubles were mostly a sales and marketing problem, it was never a manufacturing problem ... a bad product never came out of that factory."

He said historically, Serotta's best years were when the company did significant contract work in addition to its own bikes. Serotta made 7-Eleven team bikes that were labeled as Huffys and Murrays, and also made Schwinn's titanium Paramount frames for a time.

Case said several bike brands have contacted him about contract work. The Tomac gravel grinder has already been teased on Instagram by @TomacBikes. Planet X, a U.K. mail order company that bought the Titus bike brand at auction last year, apparently is licensing the Tomac brand from retired racer John Tomac.

Besides contract building for brands, Case said Saratoga would do custom private label bikes for retailers and fit studios.

As for the Serotta brand, Case said the recent turmoil has made it "too hot to touch right now," and he wasn't sure of its future. Saratoga does have an agreement to manufacture Serottas for DCG through the end of 2013.

Case said there have been no discussions with Ben Serotta about acquiring the brand, which Ben Serotta confirmed in a phone call with BRAIN late Wednesday.

"It hasn't been offered to me," Serotta said. "I'd rather that (the brand) was shelved than have bad things happen to it ... as long as it's shelved some dignity is protected."

Mad Fiber

Last month, Mad Fiber laid off seven employees at its Seattle factory and a company spokesman said Mad Fiber planned to set up production in Asia to serve OE bike makers.

According to Case, Mad Fiber is still manufacturing wheels with a reduced staff in Seattle. Asked if Mad Fiber had made significant moves toward establishing an Asian factory, Case said, "No."

The future of DCG

What will happen next for the Divine Cycling Group?

"If you ask (Divine Cycling Group principal) Dan (Devine) or I right now, we'd say we've got our hands full with where we are today. It's hard to say what we'll do next," Case said.

The original intent of DCG was to roll up several small companies, aiming for a combined annual revenue of about $10 million, where institutional financing becomes more available. Now that DCG's revenues are comprised only of Mad Fiber's and the value of the Serotta brand name, $10 million is a long way away. But Case said it's too early to think about more acquisitions.

"More acquisitions would make sense if we were operating on stable platforms, but first we have to find that stability," he said.