LOUISVILLE, Colo. (BRAIN) — When you buy 5,000 pounds of aluminum every day, you notice quickly when the cost per pound goes up 20 percent — or more — in a matter of months.

Dave Batka, owner of Wheels Manufacturing, is noticing. Since the start of the year, he's seen aluminum prices skyrocket, in part because of the tariffs the U.S. imposed on most imported steel and aluminum, and also because of rising material costs stemming from a strong economy and other factors.

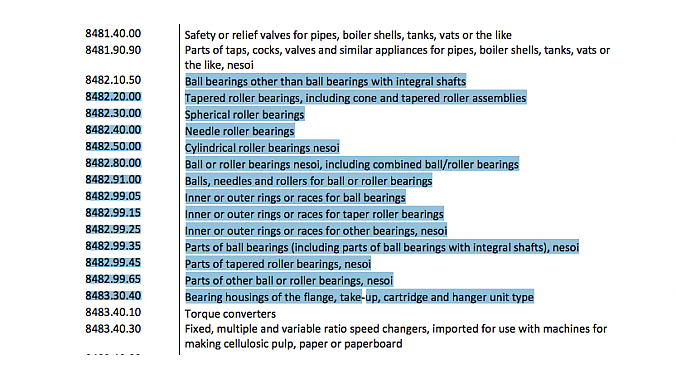

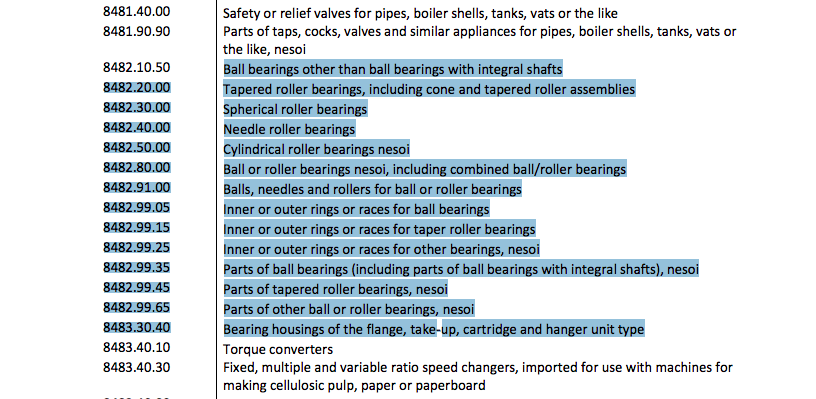

Batka is bracing for another price hike next month when a new 25 percent tariff on Chinese bearings kicks in. Along with Chinese GPS units, bearings of many varieties were included in the list of Chinese products subject to the a tariff starting July 6.

"No one makes bearings here, and bikes have a lot of bearings," Batka told BRAIN this week (Chris King Components makes bearings for its own components but doesn't sell them to other parts makers like Batka. Enduro also makes some high-end bearings in the U.S., but uses imported materials that are affected by the tariffs).

Other U.S. component makers tell BRAIN they are experiencing similar cost increases this year, even before the bearing tariff.

"All our metal is U.S.-sourced but all ships rise with the tide, and that tide has risen nearly 20 percent," said Paul Price, founder and owner of Paul Components.

"We put a margin in our pricing structure for 'normal' price fluctuations but we've blown past that so there is some teeth gnashing and hand wringing. At this point we won't raise prices but it will affect the bottom line, R&D spending and possibly compensation in the form of end-of-year bonuses," he said.

Price said he expects to be able to hold prices steady through the end of the year. "I hate to raise prices midyear," he said.

Enduro Bearings, which supplies bearings to Paul, Wheels, and most other domestic component makers and many full suspension bike makers, plans to raise bearing prices 15 percent next month.

Enduro owner Matt Harvey said he expects to raise prices for the 2019 season by 20-25 percent because of the material price hikes. Enduro's aluminum costs are up 18.5 percent so far this year, he said. Some European steel costs have increased even more.

The cost of ceramic balls, made in Japan, also has increased significantly in recent years because Tesla is gobbling up much of the ball manufacturer's capacity in order to use ceramic bearings in its electric cars.

As for the tariffs, Harvey said Enduro doesn't get all its bearings from China. Some cartridge bearings have balls from Japan and seals from Taiwan, and are assembled in Singapore. Others are assembled in the U.S., with races made of steel from France. Enduro makes about 15 sizes of bearings in the U.S., with ceramic balls from Japan and races made of French steel. The U.S.-made bearings are premium products that sell for 10-12 times the price of Chinese bearings.

Enduro's Max bearings, used in many full suspension frame pivots from brands including Santa Cruz and Specialized, are from China and will be subject to the full 25 percent tariff.

Harvey said currently, bearings from China are subject to duties ranging from 4-9 percent.

"That's not that big of a deal. But when you put a 25 percent tariff on top of that, now you are talking about a significant amount of money. That's your margin, right there, more or less. So you can't just absorb that and stay in business."

Harvey said he is exploring expanding Enduro's bearing assembly operation in Singapore, to move more assembly from China. He's also looking into drop shipping more products from China to customers in Europe and Asia.

White Industries also has seen greatly increased material costs this year, said Lynette Toepfer, the component brand's general manager.

"We purchase all USA-made material," Toepfer said. "While the USA-made material is not subjected to the tariff, the moment the tariff was mentioned, our material costs jumped by about 15-20 percent. Our costs are now higher and we are trying to compete with overseas componentry that is not subjected to any additional duties or costs. It is a problem as you can imagine and not helping U.S. manufacturing, at least in our little world."

Back at Wheels, Batka said a bottom bracket is kind of a worst-case example of the material cost increases.

"What is a bottom bracket? It's just aluminum and two bearings, really," he said.

Batka reckons the bearing tariff will add about $5 to the retail cost of an entry level Wheels bottom bracket, raising it from about $40 to $45 in the store. Higher-end bottom brackets, with pricier bearings, would see larger price increases.

Batka has bearing inventory on hand and does not expect to raise prices immediately after the tariff takes effect. And so far he has absorbed the increased material costs, but he can't do that indefinitely.

"We haven't passed-on the material costs yet," he said.

Batka said not all the bearings Wheels buys are for resale: he recently bought four China-made bearings for one of his shop's machines at a cost of $5.000. He has to replace bearings like that about once a year. "Next year, those will be $6,000 if this tariff continues," he said.