BRASELTON, Ga. (BRAIN) — Fox Factory's bicycle business, through the Fox suspension, Marzocchi suspension, RaceFace and Easton cycling brands, was up 12.7% in the first quarter this year, continuing a long run of positive results for the company.

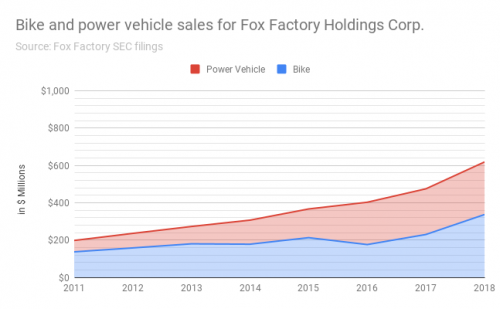

As has been the case in recent years, the bike-related sales were up significantly, but Fox's motorized-vehicle related sales were up even more — by 34.1% in this quarter (see related graph below showing Fox's growth through the 2018 fiscal year).

Overall sales were $161.7 million for the quarter, compared to $129.8 million in the same period last year. The bike sales, in Fox's Specialty Sports division, totaled $64.9 million, up from $57.7 million last year. The company said growth in the division came primarily from OEM sales.

In a conference call, Chris Tutton, who leads the Specialty Sports division, noted that Fox has completed a consolidation of the aftermarket distribution, sales and service for the bike-related brands at a new, 72,000-square-foot facility in Sparks, Nevada. He said the facility began shipping the first week in April.

In response to a question from an investor, Tutton said Fox is "well-positioned" for growth in the e-bike market, which he said was already a significant business for the brand. He predicted sales of e-bike specific products would be "a real bright spot" for the company in the next two model years. He said e-bikes are currently about 35% of the mountain bike market in Europe and 15-20% of the North America mountain bike market. He noted that some e-bike sales are shifted from traditional mountain bike sales, however. "It's not all incremental," he said.

Overall gross margins for Fox decreased 50 basis points to 31.6% compared to 32.1% in the same period last fiscal year, and adjusted EBITDA was $30.1 million, or 18.6% of sales, compared to $23.0 million, or 17.7% of sales in the same period last fiscal year.

"We started the year with record quarterly sales driven by strength in both our powered vehicle and bike offerings resulting in sales and profitability above our expectations," said Larry L. Enterline, Fox's CEO, in a statement. "Looking ahead, our team remains committed to further building Fox's brand presence in our existing business and expanding into new categories. We believe Fox's differentiated market position will continue to fuel our expansion in the diverse end markets we serve."

Total operating expenses were $29.2 million for the first quarter of fiscal 2019 compared to $25.7 million in the first quarter of fiscal 2018. The company said the increase in operating expenses is primarily due to personnel costs, higher patent litigation-related expenses, and increases in various other administrative expenses.

Patent cases continue

Fox spent $2,043,000 on patent litigation in the quarter, up from $1,344,000 in the same period last year. The litigation includes suits Fox has filed against SRAM, which are now pending in the U.S. District Court in Colorado, and suits SRAM has filed against Fox, now pending in the U.S. District Court in the Northern District of Illinois.

Fox said the suits are "moving forward" in their respective courts.

The Illinois case is related to SRAM's claim that RaceFace infringed on its X-Sync patent for wide-narrow chainrings. Fox had asked the US Patent Trial and Appeal Board to review SRAM's patent. Earlier this year the board largely upheld that patent, and Fox has appealed that decision to a Federal Circuit court. The case is now largely stalled pending a Federal Circuit court ruling on the appeal.

The two Colorado cases are related to Fox's claims that SRAM has infringed on its suspension-related patents. A final pretrial conference in those cases is scheduled for May 29.

Fox also spent $230,000 related to relocating some Specialty Sports operations from California to Nevada and expanding the Powered Vehicles Group’s manufacturing operations.

For the second quarter, Fox said it expects sales in the range of $182 million to $190 million. For the fiscal year Fox raised its outlook and now expects sales in the range of $717 million to $733 million.

Another powered vehicle acquisition.

Just before announcing its earnings, Fox announced it had agreed to purchase Air Ride Technologies, Inc., a company that produces Ridetech suspension systems for muscle cars, trucks, sports cars and hot rods. Fox will acquire Ridetech in an asset purchase transaction for approximately $14 million through a combination of cash on hand and newly issued unregistered shares of common stock of Fox. Fox expects Ridetech to contribute sales of $6 million to $8 million this year after elimination of intercompany sales.