NEW YORK (BRAIN) — Vista Outdoor says its total sales were down $460 million, or 13%, in its fiscal first quarter, which ended June 30. The company recently sold off its Savage firearms brand and made layoffs in its Action Sports division, which includes Bell, Giro, and Blackburn.

Despite poor weather, the company said sales of Bell and Giro products in the specialty retail channel were on the upswing in the quarter. "Bell and Giro grew in speciality (retail). In fact they had one of better first quarters we've had in years," CEO Chris Metz said in an investor conference call Thursday morning. Metz said Giro snow helmet and goggle sales were especially strong and said Giro moved past Oakley for second place in market share in that segment.

However, he said, Bell and Giro sales in the mass merchant retail channel were down in the quarter because its largest customer in that channel stopped orders in June to adjust its inventory.

"We see this as a timing issue and we are already seeing orders come back in July," Metz said.

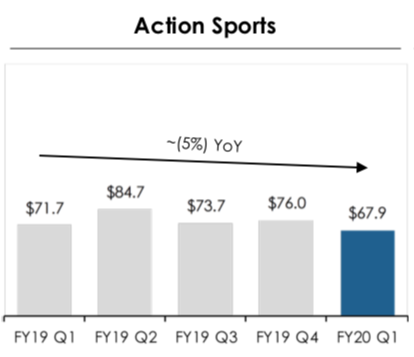

Sales in the Action Sports division were $67.9 million in the quarter, down 5% compared to the same quarter last year.

Metz said CamelBak sales are strong and the brand had exceptional results on Amazon's Prime Day promotion, when the brand sold 47,000 units, a 57% increase from the year prior.

Overall adjusted earnings per share was a loss of 8 cents a share compared to break-even results in the quarter last year.

Metz said the company still plans to invest in Bell/Giro before selling the brands.

"(REI) want us back but it takes some time, so it's not an immediate boost to us" — Chris Metz

"It's something we continue to evaluate," he said, in answer to an investor question. "Bell/Giro is a businese that we felt like we could improve and drive better value for when we do eventually sell the business. Our thoughts haven’t changed but we continue to remain open … we have got some great folks in that business that are longtime industry veterans that really help us drive the innovations and share positions that we have in the marketplace. I wouldn’t say we are pleased with the current performance, that's why we are holding on to it and improving it, but we will continue to evaluate it as we go forward."

Metz said the resumption of sales to REI following the Savage Arms sale will not immediately show up in the division's sales figures.

"It takes time. They brought other competitors in ... they want us back but it takes some time, so it's not an immediate boost to us. It's not the reason we sold Savage but we certainly should see some boost from that," Metz said.

The company said it has completed "the first phase" of a turnaround with the Savage sale and the divestiture of its eyewear brands last year. However, it said sales in its ammunition business — its largest category — remain soft, while current and upcoming new tariffs also will affect upcoming sales. It adjusted its forecast for the full fiscal year to reflect reduced revenues following the sale of Savage. It is now forecasting 2020 fiscal year sales in a range of $1.79 billion to $1.89 billion, compared to $1.94 billion to $2.03 billion, the previous forecast.

Vista is using the proceeds of the sale of the firearms and eyewear brands to pay down debt. The Savage Arms sale reduced debt by $150 million, or 20%. Vista's long-term debt balance is approximately $590 million, a 50% reduction from its peak long-term debt balance of approximately $1.176 billion.

Metz said Vista may begin adding to its brand portfolio again after it further reduces its debt load.

Metz said the Trump administration's 10% List 4 tariff increase, set to take effect Sept. 1, will affect Bell, Giro and CamelBak products that were exempt from previous tariff increases.