WASHINGTON (BRAIN) — The U.S. Supreme Court on Thursday ruled that states may require online retailers to collect sales tax revenue from online consumers who live in their states.

The National Retail Federation called the decision "a major victory" for retailers.

“Retailers have been waiting for this day for more than two decades," said NRF's president and CEO, Matthew Shay. "The retail industry is changing, and the Supreme Court has acted correctly in recognizing that it’s time for outdated sales tax policies to change as well. This ruling clears the way for a fair and level playing field where all retailers compete under the same sales tax rules whether they sell merchandise online, in-store or both."

The decision provides clarity that could lead to Congress passing legislation to create uniform national rules for collecting state taxes, to avoid a hodgepodge of individual state rules that would make the tax collection especially onerous for small e-commerce businesses.

In recent years, brick-and-mortar retailers, including bike retailers, had supported federal legislation that would create a nationwide system to collect state taxes. Legislative action has been stalled while the Supreme Court was deciding this case.

However, one online retailer, Nick Martin, the owner The Pro's Closet, argued in a 2014 BRAIN opinion piece that a system to collect state taxes nationally would be a burden on small operations.

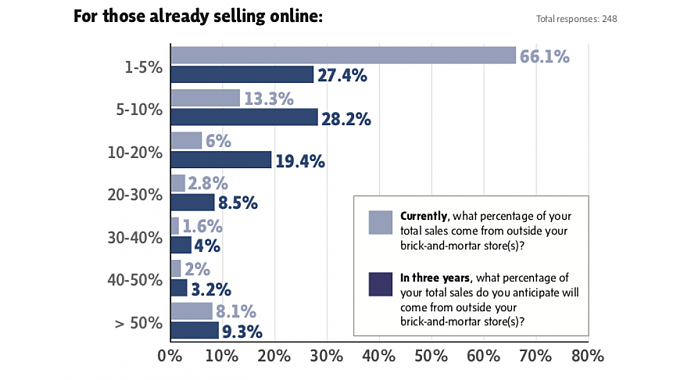

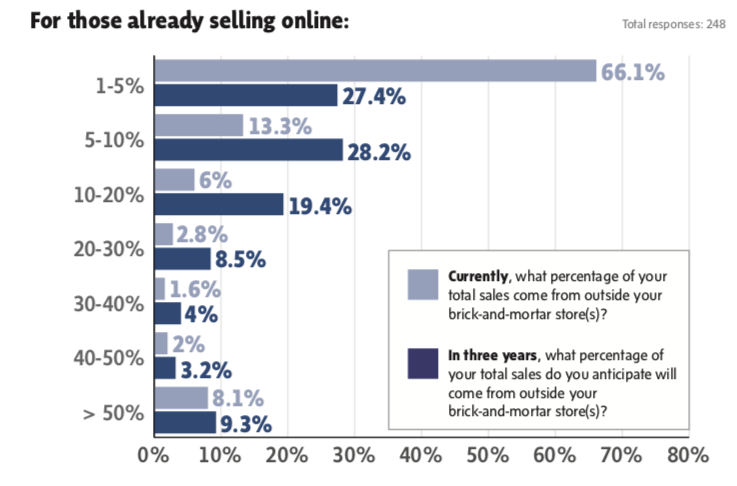

Many bike retailers do some e-commerce to complement their brick-and-mortar sales. A Bicycle Retailer retailer survey earlier this year found that 40 percent of retailers who responded do some online sales. But for 65 percent of them, online sales accounted for 5 percent or less of their revenue. The results were published in the April 1 issue of BRAIN.

The court upheld a 2016 South Dakota law requiring some online merchants — those with more than $100,000 in annual sales to state residents or 200 transactions with state residents — to collect the South Dakota sales tax, which is 4.5 percent.

The Court's decision was 5 to 4.

The case decided was South Dakota v. Wayfair; South Dakota was suing Wayfair, an e-commerce retailer that does not collect state taxes. South Dakota took the case to the Supreme Court after Justice Anthony M. Kennedy, who wrote Thursday's majority decision, had made comments indicating it was time to revisit the issue, which the court previously ruled on in the 1992 Quill v. North Dakota case.

The Quill ruling had required businesses to collect state sales taxes only from residents of states where the business had a physical presence. Kennedy said that position was archaic, "unsound and incorrect" in the internet age.

Kennedy also wrote that the concerns of small retailers, who do minimal online sales, could be dealt with by Congress or by a further court case.

"Attempts to apply the physical presence rule to online retail sales are proving unworkable. States are already confronting the complexities of defining physical presence in the Cyber Age," he wrote.

Later, he concluded, "Concerns that complex state tax systems could be a burden on small business are answered in part by noting that, as discussed below, there are various plans already in place to simplify collection; and since in-state businesses pay the taxes as well, the risk of discrimination against out-of-state sellers is avoided. And, if some small businesses with only de minimis contacts seek relief from collection systems thought to be a burden, those entities may still do so under other theories. These issues are not before the Court in the instant case; but their potential to arise in some later case cannot justify retaining this artificial, anachronistic rule that deprives States of vast revenues from major businesses."

More than 40 states had submitted testimony in favor of upholding the South Dakota law. Some states that lack a broad sales tax, including New Hampshire, Montana and Washington, had submitted arguments to the court taking the opposite position. Besides the NRF, the National Sporting Goods Association and other retail trade groups had supported overturning the Quill decision.

Katy Hartnett, PeopleForBikes' director of government relations, said, "Online sales tax collection is important to bicycle retailers, who are heavily invested in communities across the country."

A federal audit said states lost $13.7 billion in uncollected sales tax revenue last year.

Many large online retailers, including Walmart, Target and Apple, already collect state taxes. Amazon collects state sales tax on items it sells directly, but third party vendors on Amazon are currently not required to collect the tax. Likewise, eBay currently does not require sellers to collect state sales taxes.

Watch for this story to be updated later Thursday with reaction from the bike industry.

Related articles

- Bike retailers go to DC to push for online sales tax legislation — July 7, 2016

- Online bike retailer responds to state sales tax debate — Oct. 7, 2014

- NBDA president calls for sales tax fairness — Sept. 24, 2014

- IBDs welcome online sales tax legislation — March 27, 2013