When you want the birds-eye lowdown on what’s happening in the U.S. e-bike market, the person to talk to is Ed Benjamin.

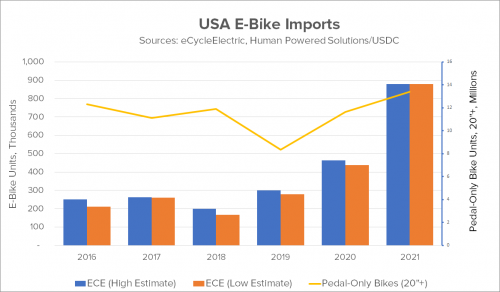

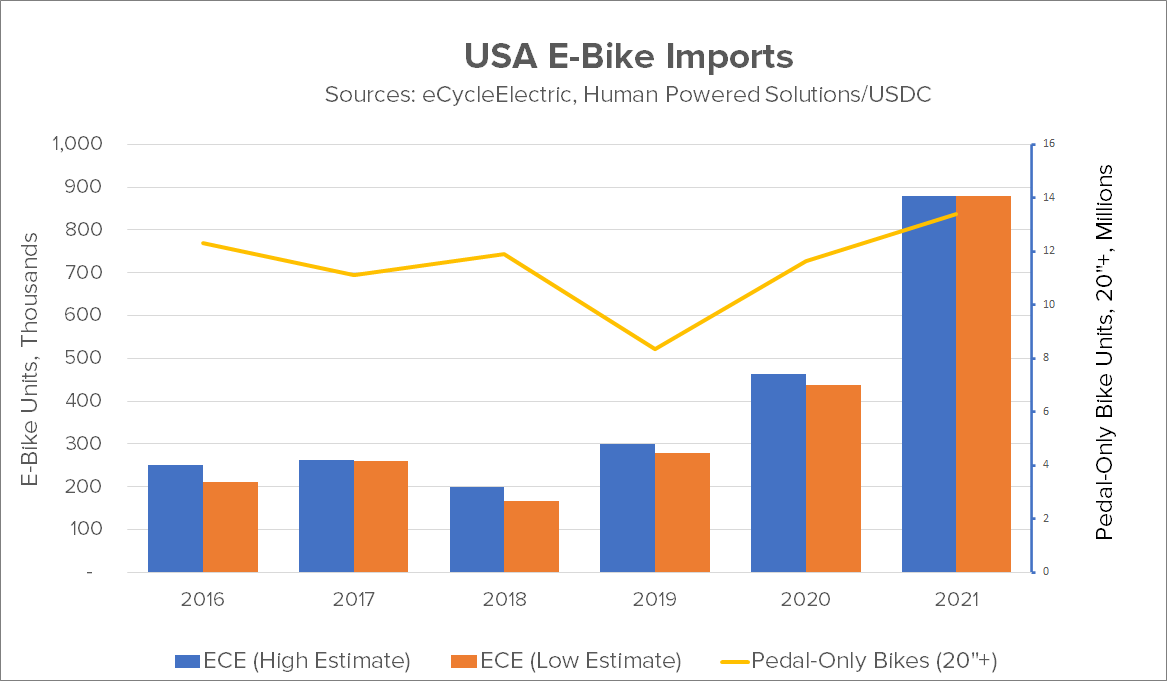

Among other things, Benjamin’s company, eCycleElectric, tracks imports of e-bikes. That’s a more difficult job than it sounds, since e-bikes can be imported under more than a dozen different HS numbers (Department of Commerce import codes) and Benjamin’s company has to track every one of them, for hundreds of importers.

When we looked at the e-bike market last year, IBD sales were emerging as the category leader, but that’s no longer the case. The rise of sophisticated B2C brands selling at or near what has traditionally been bike ship price territory is a signal that more Americans are ready to make a quality e-bike purchase without benefit of a test ride, assembly or after-sale service from the supplier. More about that in a minute, but first let’s take a look at the electric bike market overall for 2021.

“The business continues to be very vigorous,” Benjamin says with characteristic understatement. “My guess is we’ll break a million units sometime in 2022 or 2023.” So, in a time of consistent product shortages, where did all this inventory come from? Back in 2020, as the Covid pandemic hit and most IBD bike brands were frantically canceling orders, hundreds of e-bike brands, both B2B (including Specialized) and B2C, made huge bets that the e-bike market would skyrocket…and those bets paid off.

How D2C sales are taking over the market

“In terms of percentage change, other channels are streaming past bike shops,” Benjamin says. “In fact, D2C brands like Rad Power or Aventon are dominating at the $1,500 price point. $2,500 seems to be the starting price at bike shops. As far as I know, most D2C companies offer something in the bike shops’ price points,” he continues. “It’s not their best sellers, but they’re creeping into bike shop territory. The fact that bike shops still exist is a testimony to their resilience, but they’re being rapidly overtaken by D2C brands.”

“Bike shops have gotten a little better in the last 20 years, but the D2C people have become freaking awesome in terms of quality of the product, assembly, packaging and customer service.” —Ed Benjamin

How is this possible? Simple, Benjamin says. The best D2C brands are mastering the arts of customer satisfaction and customer service. At the same time, the pandemic has taught Americans to become experts at buying direct. Benjamin is emphatic about the nature of this shift. “Going to a brick and mortar store is no longer the obvious thing to do,” he states. “More importantly, D2C brands are becoming experts in taking care of those customers. Their service is getting better, and so are the products they offer in terms of service and reliability.”

This may seem unlikely, given the horror stories many dealers tell about getting consumer-direct e-bikes in for service. But there’s a certain amount of confirmation bias built into that observation, too. After all, bike shops only see D2C bikes when they have problems. The ones where everything goes well are effectively invisible to the channel.

“Bike shops have gotten a little better in the last 20 years, but the D2C people have become freaking awesome in terms of quality of the product, assembly, packaging and customer service,” Benjamin says. “The amount of information they routinely offer about the bike is greater than what the bike shop employee knows about the product. Bike shops should have an advantage because you can test ride the product, but that doesn’t seem to be happening. Now D2C brands are targeting bike shop price points. Will they get there? I don’t know.”

“The Achilles heel of the D2C model is service,” Benjamin points out. But most e-bike problems are bicycle problems — flat tires and so forth. Working on electric bike parts is harder and a lot of bike shops won’t work on bikes that weren’t purchased there.

Despite this, bike shops are becoming more flexible about repairing e-bikes. LEVA, the Light Electric Vehicle Association, of which Benjamin is founder and chairman, has had 1,600 people come through its e-bike repair program in the last few years, “and probably a thousand of them are bicycle mechanics. I think we need about 8,000 to establish a critical mass of available service people,” Benjamin adds, “not just in bike shops but mobile mechanics and one-person repair services.”

B2C + lower-maintenance bikes = Bike 4.0?

A growing consumer-direct market is one thing, but Benjamin’s most radical notion is that the increasing power of D2C sales to transform the bicycle itself.

Direct-to-consumer sales are booming, he points out, both in e-bikes and pedal-only models. And D2C will continue to become a bigger slice of both markets. As stated earlier, the Achilles heel for the D2C channel is service. So what better way to minimize the service issue than to make bikes that require less of it?

Bearings, brake shoes, spokes, tires, cables and other miscellaneous items all need service, Benjamin agrees. But they all can become less service-intensive. Bearings will get longer-lasting. Wire spoke wheels will become rare and cast wheels are already becoming cheap and very accurate. And we’re already seeing a move away from cables to hydraulics.

D2C brands have the profit margins to absorb the higher initial cost of low-maintenance components without raising retail prices, Benjamin says. But over time, the cost of these parts will come down, just as it has with automobiles.

“The (bicycle) industry could, if it chose, ship a bicycle to the consumer that needs little or no service, just like today’s cars. It’s just a matter of engineering and industry mindset.” — Ed Benjamin

“The automobile industry is already at this point,” Benjamin says. “Car warranties in the 1960s were 12,000 miles. Nowadays it's 50 or 100,000. Consumers are expressing a preference for bikes shipped directly to them. The (bicycle) industry could, if it chose, ship a bicycle to the consumer that needs little or no service, just like today’s cars.”

“It’s just a matter of engineering and industry mindset,” he says. We don’t have those parts now, but there are suppliers who can make it happen and some of them are doing it right now. Quality batteries are now coming with a five-year warranty; there are e-bikes that have been ridden for the past ten years and the batteries are still going strong. And long term, it doesn’t actually have to cost more.”

Over time, the lower-maintenance bicycle will come down in cost as manufacturing scales to meet demand, Benjamin says. E-bikes may well lead that evolution, just because the electric market is more accepting of change.

For all that, it’s not clear that the brick-and-mortar retail channel will be out of business anytime soon. As we go to press with this story, Rad Power, the industry leader in D2C e-bike sales has just announced it will be opening five new physical retail locations in major US markets in 2022. Still, Benjamin sees a rosy future for D2C, to the extent where it may start to remake the bicycle itself. Will dealers be relegated to the role of showrooms and service centers? “That’s already happening,” says Benjamin.

“I grew up in bike shops, I’ve owned bike shops and I will be sad to see them go.” But the evolution is already in place, he says, and its ability to fundamentally alter the entire IBD channel is only a matter of time.